Understanding Interest Rates: A Key Pillar of Monetary Policy

Whether you're managing your portfolio or simply trying to understand the direction of the economy, interest rates are the first place to look. These rates set or influenced by central banks, determine the cost of money, the incentive to invest or save, and the general tone of financial markets.

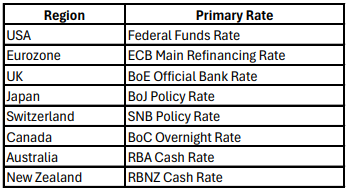

But not all interest rates are the same. From the Federal Funds Rate in the U.S. to the Main Refinancing Rate in Europe, different central banks use different tools to guide their economies. Understanding them is key to interpreting policy shifts and market reactions.

💡 What Are Interest Rates, Really?

At their most basic level, interest rates are the price of borrowing money. But in the world of macroeconomics, they are much more:

They are the steering wheel of the global economy.

When central banks set interest rates, they’re deciding how easy or difficult it should be for money to move through the system. That, in turn, influences:

Business investment decisions

Mortgage and credit card costs

Inflation and job creation

Currency strength

🧱 The Key Types of Interest Rates

Let’s break down the core types of central bank rates:

🛠️ How It Works in Practice

Let’s take some real-world scenarios:

U.S. Federal Reserve

When the Fed raised the Federal Funds Rate in 2022 from near-zero to over 5%, mortgage rates jumped from ~3% to over 7%. That cooled down the real estate market, reduced household borrowing, and helped bring inflation down from 9% to under 3%.European Central Bank (ECB)

When the ECB increased its Main Refinancing Rate from 0% to 4.5% over 18 months, banks became more cautious with lending. Companies in Europe delayed capital investments, and the euro gained value against other currencies like the yen and the dollar.

🌍 Global Logic – Local Variations

Different regions use different mechanisms, but the underlying goal is the same: to influence inflation, credit growth, and overall demand.

📈 Why Markets Obsess Over Rates

The financial system is tightly wired to interest rates. A 0.25% move can shift billions of dollars in asset valuations.

Stock Markets: Higher rates reduce the present value of future earnings → often bearish for equities

Bond Markets: Rising rates → falling bond prices (and vice versa)

FX Markets: Higher rates attract capital inflows → currency appreciates

Real Estate: Mortgage rate shifts directly affect housing demand and prices

Example:

In 2023, just one hawkish comment from Fed Chair Jerome Powell caused U.S. 10-year Treasury yields to spike 40 basis points within days—triggering a global risk-off sentiment across equities.

Interest rates aren’t just technical numbers on a central bank’s balance sheet. They are the pulse of the macro economy and the key signal investors use to price everything from real estate to tech stocks.

To understand the true movement of price, focus on the narrative behind the global rate environment:

Are central banks ahead or behind inflation?

Is a rate pivot coming?

How are forward expectations shifting?

Whether you're just getting started in markets or managing institutional capital, having a firm grasp of how interest rates work gives you a meaningful edge.

Stay informed and unlock alpha with Gauch-Research. 🚀