The Repo Market Explained

Institutional Insight

Introduction

In recent years, the repurchase agreement (repo) market has once again captured the attention of global macro participants, risk managers, and policy makers. Despite its fundamental role in the functioning of modern financial markets, the repo market remains often misunderstood outside of specialized dealer and central banking circles. Its size, complexity, and centrality to liquidity provision make it a critical node in the global financial system.

In this primer, we will dissect the mechanics, participants, risks, and evolving role of the repo market — providing a comprehensive institutional framework for understanding this cornerstone of global market liquidity.

1. What Is the Repo Market?

At its core, a repurchase agreement (repo) is a short-term secured lending arrangement. One party sells securities (typically government bonds, agency debt, or high-grade collateral) to another party with the agreement to repurchase them at a later date (often overnight) at a slightly higher price.

The difference between the sale price and repurchase price is the repo rate, effectively the interest on the loan.

From the perspective of the cash provider, it's a collateralized loan.

From the perspective of the securities provider, it's a way to obtain short-term funding.

Despite the simplicity of its contractual structure, the repo market is multi-layered, operating simultaneously as:

A critical source of short-term funding for banks, broker-dealers, and hedge funds.

A mechanism for collateral transformation and balance sheet optimization.

A key instrument for central banks to implement monetary policy and manage liquidity.

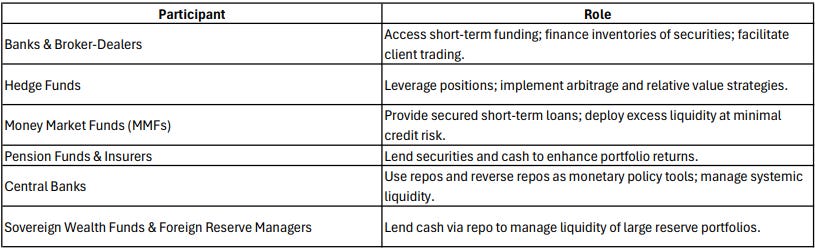

2. The Participants

Understanding the repo market requires mapping its major participants:

The global repo market is one of the few venues where credit, collateral, liquidity, and interest rates intersect on a daily basis — creating both opportunity and systemic risk.

3. The Mechanics: A Closer Look

A typical overnight repo trade works as follows:

Day 1: Party A sells securities worth $100 million to Party B.

Party B delivers $100 million in cash to Party A.

Day 2: Party A repurchases the securities at $100.01 million.

The $10,000 difference reflects the overnight repo rate (~3.65% annualized in this case).

Key mechanics include:

Haircuts: A discount applied to collateral to account for market and credit risk. For U.S. Treasuries, haircuts are typically 1-3%. For lower grade collateral, higher.

Margining: For longer-term repos, margin calls adjust for price changes in the collateral.

Rehypothecation: The reuse of collateral by the lender for its own funding or trading needs.

Tri-party Repos: Managed by custodial agents (e.g. BNY Mellon, JPMorgan), allowing for collateral management and operational efficiency.

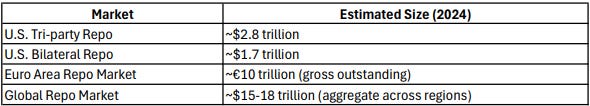

4. The Repo Market in Numbers

While opaque, BIS and regulatory data offer rough magnitudes:

Daily turnover is extremely high, with most repos maturing overnight or within a few days. This underscores how central repo is to short-term dollar and euro funding markets.

5. The Repo Market’s Macro Role

Liquidity Provision

Repos ensure that institutions with excess liquidity (e.g. MMFs) can allocate short-term funds safely, while those in need of liquidity (e.g. broker-dealers, leveraged funds) can borrow at competitive rates.

Monetary Policy Transmission

Central banks conduct open market operations (OMOs) using repos to inject or drain reserves from the banking system. In the post-GFC world, the Federal Reserve’s Standing Repo Facility (SRF) and Reverse Repo Facility (RRP) are major stability anchors.

Collateral Velocity

Repos are key to collateral circulation. The ability to transform, rehypothecate, and reuse collateral is critical for:

Derivative margining

Structured finance

Interbank lending

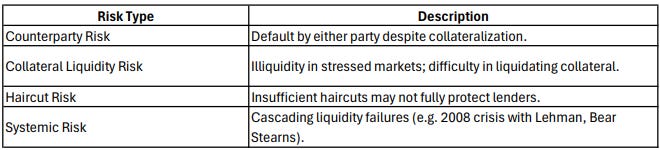

6. Risks in the Repo Market

Despite its secured nature, the repo market carries several layers of risk:

The 2019 U.S. Repo Market Shock — where overnight rates spiked from ~2% to over 10% — highlighted how fragile short-term funding markets can become when liquidity mismatches arise unexpectedly.

7. Structural Evolutions: 2008 and Beyond

Pre-GFC World

Dealer-centric

Heavy bilateral exposures

Lower transparency

High reliance on weaker collateral (e.g. private-label MBS)

Post-GFC World

Higher capital and liquidity requirements (Basel III, LCR, NSFR)

Greater role for central clearing

Tri-party reforms

Central bank backstops (e.g. Fed’s SRF and RRP)

The Shadow Banking Link

The repo market is deeply intertwined with non-bank financial intermediaries (NBFIs), creating complex interdependencies outside of traditional banking supervision.

8. Repo and Macro Strategy

For institutional macro and credit allocators, the state of the repo market offers important forward signals:

Funding stress → Volatility transmission

Collateral scarcity → Treasury basis trades

Central bank activity → Monetary stance transmission

Repo rate spreads → Credit market risk appetite

Sophisticated hedge funds increasingly monitor repo rate spreads (e.g. SOFR-OIS, GC-IOER spreads) as early stress indicators, particularly in periods of rising rate volatility and liquidity repricing.

9. The Future of Repo

Looking ahead, several structural themes are reshaping repo dynamics:

Digitalization: Tokenized collateral and DLT-driven repo platforms.

Cross-border coordination: Global dollar liquidity transmission (e.g. via FX swap markets).

Regulatory oversight: Ongoing Basel III Endgame discussions may reshape balance sheet costs.

Climate-related collateral eligibility: Potential adjustments to eligible collateral frameworks.

The repo market is evolving, but its role as the plumbing of global liquidity remains foundational. For institutional investors, understanding repo dynamics is no longer optional — it is central to navigating macro, credit, and risk in modern capital markets.

Closing Thoughts

While often described as “boring” plumbing, the repo market is anything but. It is the foundation upon which modern leverage, liquidity, and monetary policy transmission are built.

Understanding the repo market is, in essence, understanding the heartbeat of global finance.

Stay informed and unlock alpha with Gauch-Research. 🚀