The Global Dollar Circuit: The Hidden Engine of the World Economy

The global financial system depends on an international dollar circuit that operates far beyond the borders of the United States. This structure is the backbone of global credit creation, international trade and cross-border liquidity. It also represents one of the most misunderstood pillars of modern macroeconomics. Anyone who overlooks it misreads the mechanics that govern financial stability and global growth.

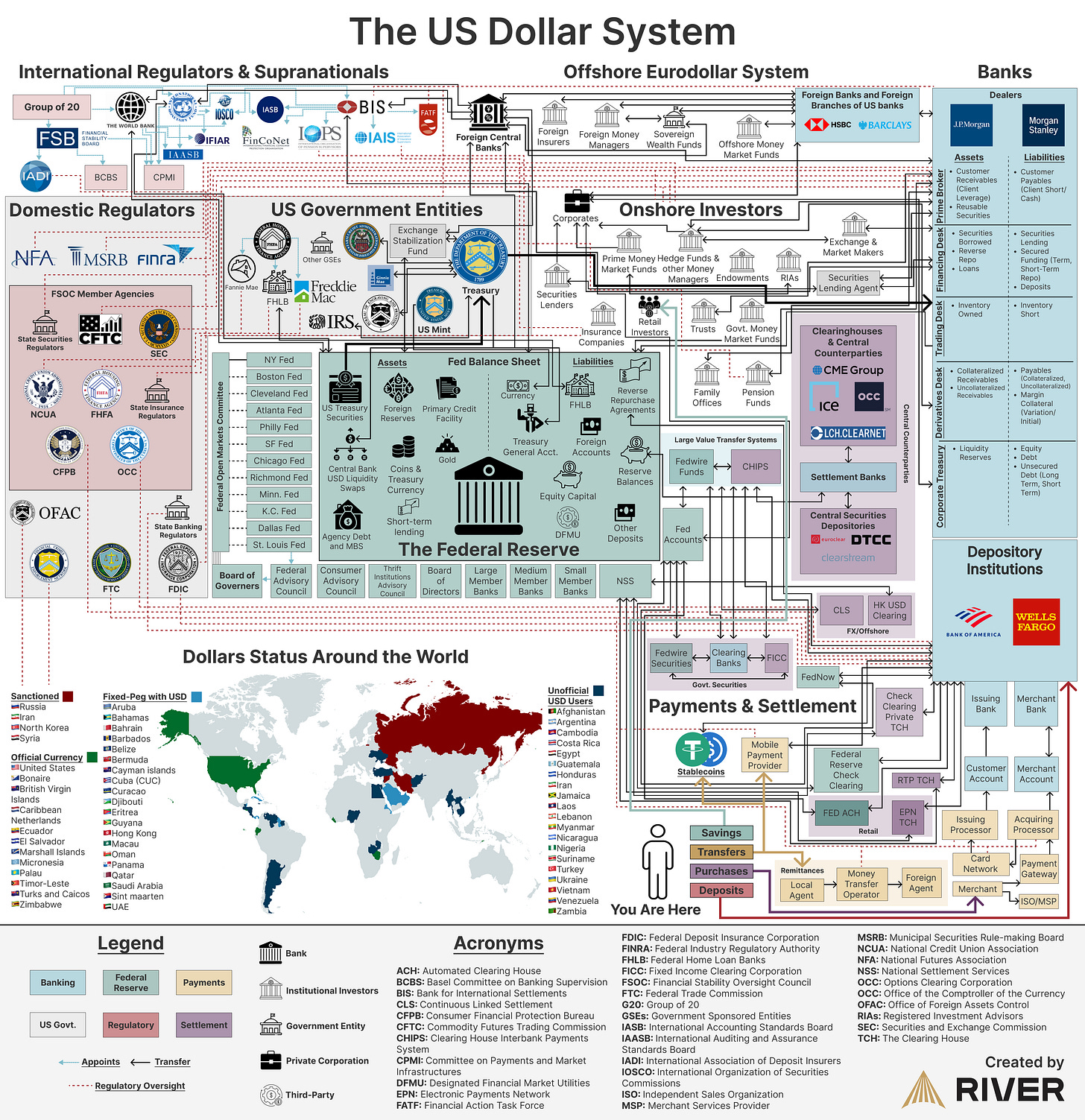

The Architecture of the Dollar Circuit

A large share of global debt is denominated in US dollars. Corporations, sovereigns and financial institutions rely on the dollar because of its unmatched liquidity, its legal infrastructure and the depth of US capital markets. What most observers fail to understand is that a significant portion of these dollars does not originate in the United States. They are created offshore by international banks through what is commonly known as the Eurodollar system.

Banks outside the United States issue dollar denominated loans without holding reserves at the Federal Reserve. Deposit balances and loan balances in US dollars appear on their books through internal ledger expansion. This process mirrors domestic money creation inside the United States, but without any direct regulation from the Federal Reserve or US policymakers.

The result is a parallel monetary universe that evolves independently from the official US monetary base.

Macroeconomic Implications of the Offshore Dollar Market

The offshore dollar market has grown to a magnitude that dwarfs the scale of many national banking systems. Its size is difficult to measure precisely, yet estimates range from several trillions to well over ten trillion dollars. Its macroeconomic relevance is profound. It creates a leveraged, globally interconnected structure that is extremely sensitive to liquidity shocks.

Emerging markets are particularly exposed. Their governments and corporations rely heavily on dollar funding, yet they lack sovereign control over the currency that underpins their liabilities. When stress emerges in the offshore market, funding costs can rise abruptly. Banks may face refinancing difficulties. Liquidity dries up. Capital flows reverse. Entire economies become vulnerable to currency depreciation, higher debt servicing costs and sudden stops in external financing.

The Role of Central Banks through Dollar Swap Lines

During moments of severe market stress, the Federal Reserve becomes the lender of last resort for institutions that do not operate inside the US banking system. This role is exercised through dollar swap lines extended to foreign central banks. These swap lines allow central banks to obtain dollars directly from the Federal Reserve and redistribute them to domestic institutions facing shortages.

The mechanism stabilizes offshore markets, but it is not a standing global guarantee. Access is limited to selected central banks. The system is therefore structurally fragile because institutions that operate in dollars are not universally connected to a lender of last resort. A gap remains between global dollar liabilities and the global capacity to backstop them.

Structural Risks Embedded in the Dollar Circuit

The eurodollar mechanism carries several macroeconomic risks.

It is inherently procyclical. During peaceful periods, credit expands easily, often beyond the pace of domestic economic fundamentals. During periods of stress, the same mechanism contracts aggressively. Banks withdraw credit and reduce balance sheet size. Liquidity evaporates.

It enables regulatory arbitrage. Institutions operating offshore are not bound by the same capital and liquidity requirements as those inside the United States. This can create imbalances that remain invisible until a crisis exposes them.

It amplifies sovereign vulnerability. Countries with high levels of dollar denominated debt face immediate pressure when dollar liquidity tightens. Their fiscal positions can deteriorate rapidly even without domestic policy errors.

The absence of a global authority with full jurisdiction over this market ensures that systemic risks can build silently until they reach a breaking point.

Why the Dollar Remains Uncontested

Despite political rhetoric and periodic discussions on de dollarization, the structural dominance of the dollar persists. It is sustained by the liquidity of US Treasury markets. It is reinforced by trust in US legal institutions. It is accelerated by network effects that make it rational for global participants to continue using the dollar because everyone else does.

The dollar has evolved into a global monetary infrastructure. It is not simply a national currency. It is the operating system of international finance.

Macro Takeaways for Investors and Policymakers

Dollar liquidity dynamics influence global markets far beyond the stance of US monetary policy. Investors must understand that offshore dollar shortages can create global risk offs independently from domestic US recession signals.

Policymakers outside the United States need strategies that enhance the resilience of their institutions to dollar funding stress. These include stronger domestic liquidity buffers, improved maturity structures and credible contingency plans for market dislocations.

The international community may also need to reconsider its approach to systemic risk. The global dollar circuit is too large and too central to operate without comprehensive oversight.

The global dollar circuit is the hidden engine of the world economy. It supports trade, investment and credit creation, but it also represents one of the most powerful sources of macroeconomic fragility. Understanding its design, its weaknesses and its influence on global liquidity conditions is essential for any serious macroeconomic analysis.

Ignoring it is not an option for investors, policymakers or institutions that wish to navigate the global economy with clarity.

Stay informed and unlock alpha with Gauch-Research.

Neighbor, this breakdown hits home — especially when you look at it through a Jamaican lens.

What you’re describing in the global dollar circuit isn’t theoretical for small economies like ours. We feel it every time the offshore dollar market tightens.

A few parallels stood out immediately:

1. Jamaica knows the pressure of owing in a currency we can’t print.

Our government, businesses, and financial institutions have long carried US-denominated liabilities. When dollar liquidity dries up offshore, even if local fundamentals remain steady, we feel it instantly through higher servicing costs and foreign exchange pressure.

2. The “parallel dollar universe” you outlined is exactly what sits behind our sudden spikes in USD demand.

People often blame local policy alone, but the real drivers are often upstream: offshore funding stress, liquidity squeezes, or shifts in global risk appetite.

3. Your point about swap lines hit hard.

Countries like Jamaica aren’t on the list.

So, when offshore dollar credit contracts are in place, we don’t have a built-in fire hose. We must ride the wave with buffers, reserves, and discipline, or risk getting caught in the undertow.

4. The procyclical nature of the Eurodollar system mirrors our historic boom-and-bust cycles.

Easy global credit fuels growth; tightening global credit hits us even when we’ve done everything right at home.

5. The big truth you landed on is the one Jamaica has lived with for decades:

The dollar isn’t just a currency. It’s the infrastructure the world runs on. Opting out isn’t a realistic choice. Managing exposure is.

Your piece explains the system that has quietly shaped the Jamaican economy since independence, and how our vulnerabilities are tied to forces far beyond our shoreline.

Thanks for laying it out with this kind of clarity.

— Delroy A. Whyte-Hall

Whyte-Hall Communications Network

Off-Market Influence Newsletter

https://whytehallcommunications.com

| https://offmarketinfluence.com

P.S.: I am currently residing in Maryland.