Market Update

27.07.2025

This Week’s Market Outlook “Calm Before the Storm”

Welcome back to this week’s Market Update. As always, I’ll keep things concise, insightful, and this time with more charts and visual context to help illustrate the bigger picture.

Looking back

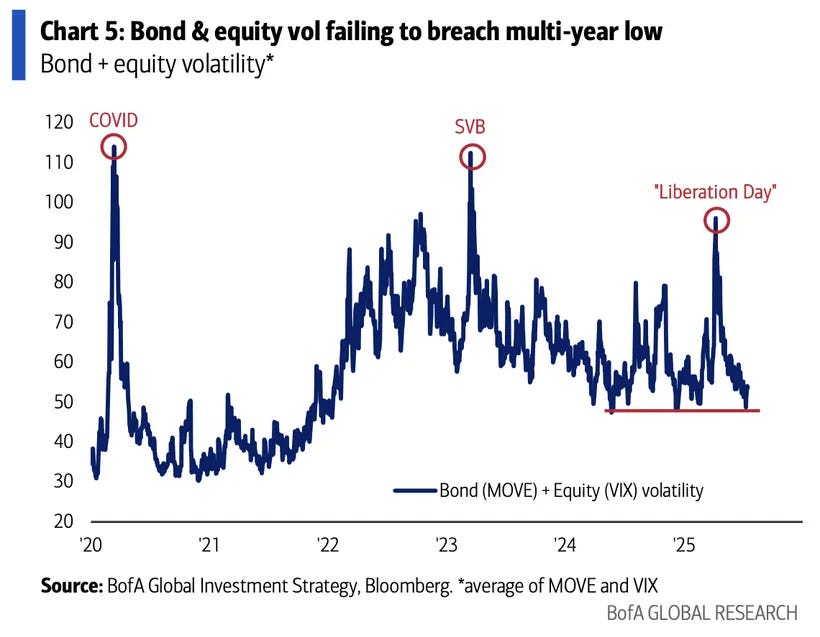

We’re clearly in the middle of the typical summer lull. Markets are showing reduced volume and tight ranges, with the occasional spike in volatility, largely thanks to Trump’s recent appearances. Despite that, US equities continue their impressive run, setting new all-time highs.

Last week’s economic calendar was relatively quiet. Aside from strong PMI figures in the services sector, there were no major data releases worth mentioning.

But that calm may not last.

Looking ahead, the coming week is packed with potential catalysts and the market may not stay quiet for long.

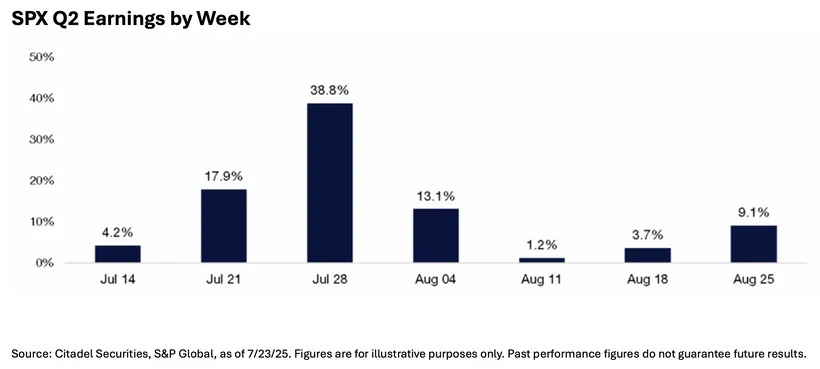

First, we enter the most critical phase of earnings season, with heavyweights like Meta and Microsoft reporting. Investor expectations are high, and any surprises could shift sentiment quickly.

Wednesday will bring the latest US GDP data. Forecasts point to a Q2 rebound of 2.3 percent, a sharp turnaround from the previous -0.5 percent, which had been distorted by frontloaded tariff effects.

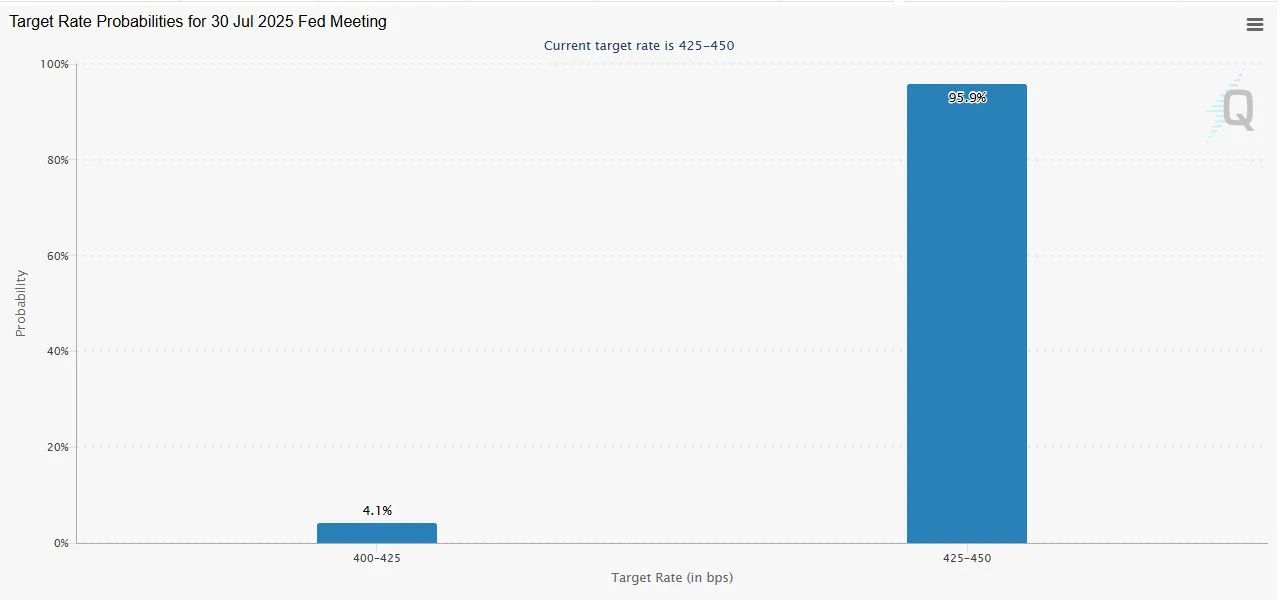

Later that day, we’ll also get the Fed’s rate decision and press conference. Markets widely expect rates to remain unchanged, but all eyes will be on Chair Powell’s tone, especially after Trump’s recent visit to the Fed’s Eccles Building. A more dovish stance could put additional pressure on the US-Dollar.

On Thursday, the spotlight shifts to Japan, where the Bank of Japan will announce its policy rate. A hike would be significant, considering how the BoJ’s move last August triggered global ripples through the unwinding of the yen carry trade.

Also on Thursday afternoon, we’ll see the Core PCE inflation data, the Fed’s preferred inflation gauge. This will be the key release for assessing whether tariff-related costs are starting to feed through to consumers. A weaker print would likely raise the probability of a rate cut in September.

To finish off the week, we’ll get the latest US labor market data, including non-farm payrolls and average hourly earnings. A slight cooling is expected, but with inflation still elevated, the Fed’s primary focus remains price stability.

Bottom line

This week has all the ingredients for increased implied volatility. Disappointing GDP, Core PCE, or labor data could send the dollar toward the 96.00 level. Stronger readings could push it closer to 99.00.

Stay sharp, my friends. Things might get interesting.

Current Market Views:

US Dollar: Neutral to Bearish

Depending on this weeks Data and FOMC Press Conference

Gold: Neutral to Bullish

Gold remains an attractive Hedge for upcoming Uncertanties

EUR/USD: Neutral to Bullish

If the Data remains weak for the Dollar, I would be looking to take some Longs towards the 1.19 Level

Stocks I'm Currently Watching:

CMG: Chipotle Mexican Grill

Chipotle’s recent marketing initiatives and menu innovation are expected to support a rebound in same-store sales growth in the second half of the year. Early signs are encouraging, with transaction trends improving in July, and the company executing a targeted plan focused on affordability and operational consistency. These efforts could help offset the slower momentum seen earlier this year.

That said, Chipotle’s updated guidance for flat same-store sales in 2025 underscores ongoing challenges. Persistent macroeconomic headwinds, weaker consumer demand, and tough year-over-year comps continue to weigh on expectations. Several analysts have raised concerns over what could be the weakest quarterly growth outside of recessionary years, putting the strength of a near-term rebound into question.

Despite this, the company’s financials remain solid, and its long-term positioning in the fast-casual space is still compelling. Given the current setup and potential risk-reward profile, I’ll personally be looking to accumulate shares at opportunistic levels, purely as a reflection of my own strategy (this is not financial advice).

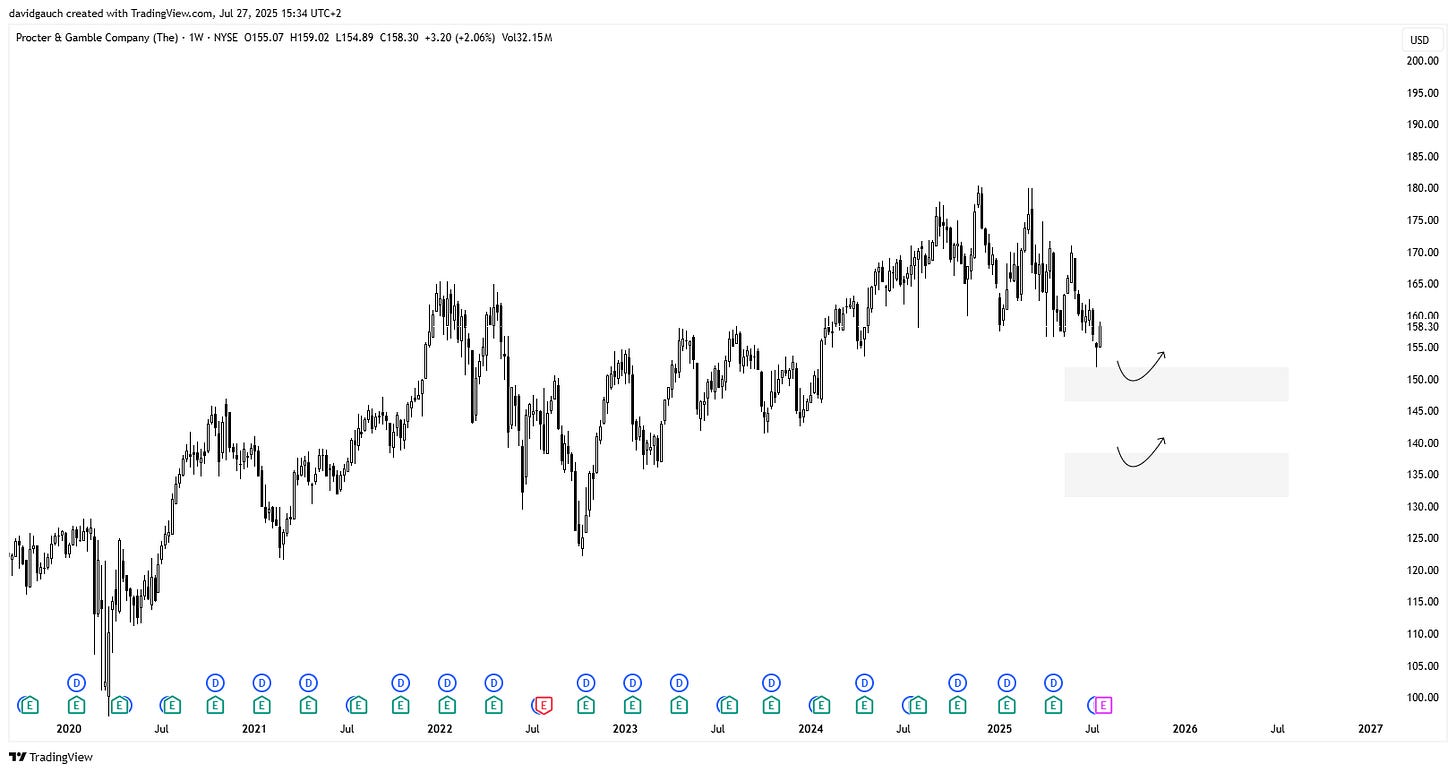

PG: Procter & Gamble:

Investor concerns around Procter & Gamble continue to focus on muted earnings revisions, with the latest Zacks Rank reflecting a still moderate outlook. From a valuation perspective, both the Forward P/E and PEG ratio indicate that the stock is trading at a premium relative to expected growth. This could expose the shares to downside risk should organic sales growth or profitability margins soften in the quarters ahead.

On the other hand, P&G remains widely viewed as a defensive compounder, underpinned by a diversified portfolio of essential consumer brands, strong margin resilience, and disciplined cost controls. The company continues to deliver robust cash flows and has a long-standing commitment to shareholder returns through dividends and buybacks.

The analyst consensus stands at Moderate Buy, with the average price target still implying double-digit upside. For many, these fundamentals support the case for continued earnings stability, even in a slower growth environment.

Stay informed and unlock alpha with Gauch-Research. 🚀