Market Update

03.08.2025

This Week’s Market Outlook “It might be too late…”

Welcome back, my friend! This week’s post wraps up everything you need to know from the past trading days, so you can spend less time digging through data and more time making sharp decisions. Let’s dive in.

Last Week in Review – What Moved the Markets?

JOLTS Job Openings: 7.44M vs. 7.51M expected (previous: 7.71M)

→ Slight cooling in demand, but markets shrugged it off.CB Consumer Confidence: 97.2 vs. 95.9 expected (previous: 95.2)

→ A modest rebound since the April low of 86.0, still a fragile recovery.ADP Non-Farm Employment Change: 104K vs. 77K expected (previous: -23K)

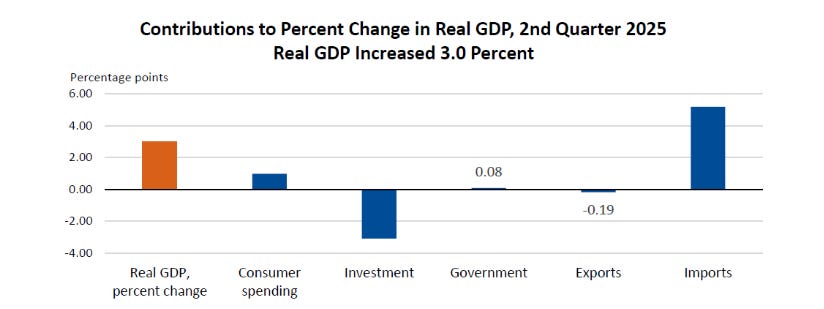

→ Not a blowout number, but not a disaster either.Advance GDP (Q/Q): 3.0% vs. 2.5% expected (previous: -0.5%)

→ Strong headline, but… not so fast.

Real Final Sales to Private Domestic Purchasers came in at just 1.2%, down from 1.9%, a more accurate reflection of actual domestic demand. Much of the GDP surprise came from collapsing imports, which artificially inflated the GDP-number.

Let’s just say: this is not the kind of growth you want to brag about.

Fed Funds Rate: Held steady at 4.50%

→ As expected. Powell remained hawkish at the press conference, despite Trump’s recent visit to the Eccles Building. Time will tell if that tone was a mistake. Markets priced out the second cut for 2025 after.

Bank of Japan Policy Rate: Unchanged at <0.50%

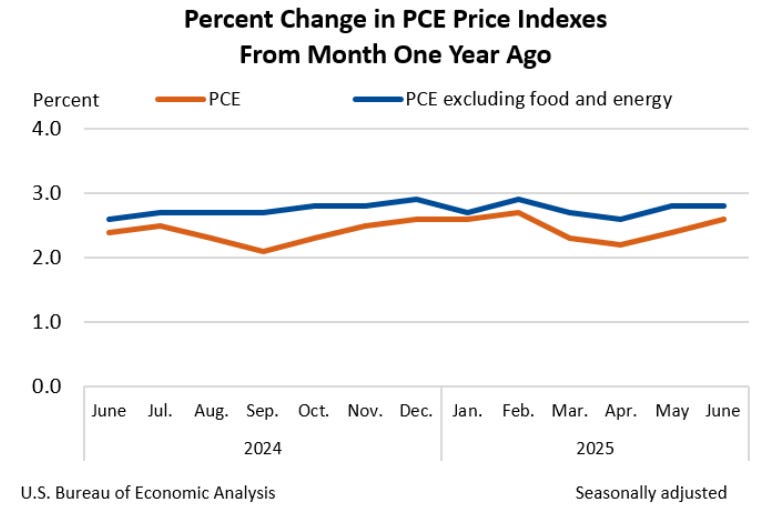

→ No changes. No surprises. Markets barely reacted.Core PCE Price Index: 0.3% MoM (in line)

→ First market reaction in DXY: neutral to mildly bullish.

Annualized core PCE (ex-food and energy) is at 2.8%, still far above the Fed’s 2% target. Sticky inflation remains a headache.

Average Hourly Earnings: 0.3% MoM (expected)

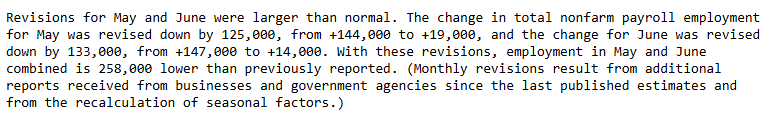

→ A healthy sign: wage growth keeps up with prices (for now).Non-Farm Payrolls: 73K vs. 106K expected (previous: 147K)

→ Not great. And it gets worse…

May and June figures were revised down by a whopping 258K. New totals: May = 19K, June = 14K. That, my friend, is not a stable labor market.

Market reaction? Textbook recession fear playbook:Treasury yields ↓

Treasuries ↑

USD ↓

Stocks ↓

Gold ↑

If next month shows similar weakness, a 50 bps rate cut in September would no longer be off the table.

What’s Coming Up This Week?

It’s relatively calm on the data front:

Tuesday: ISM Services PMI (US)

Thursday: Bank of England rate decision + monetary policy report

Other than that, a breather, unless the market decides otherwise.

My Market Outlook This Week

I entered last week with a fairly bullish USD bias and caught some nice upside. Technically, the dollar still looks fine, but I’ll be cautious early in the week (Monday/Tuesday) as markets digest the shock of Friday’s labor data.

If things stabilize, I’ll likely re-engage USD longs, especially against the British Pound, which continues to suffer from weak macro data and potential dovish surprises at Thursday’s BoE meeting.

I'm also eyeing a EUR/GBP long as a tactical play.

As a potential hedge I’d welcome a retracement in gold to re-enter long.

USD:

EUR/GBP:

Gold:

Stay informed and unlock alpha with Gauch-Research. 🚀