Market Update

29.09.2025

This Week’s Market Outlook “Nothing ever happens…“

Hello dear friends and readers, and welcome back to another market update on this beautiful Monday. Unfortunately, it was a busy weekend, so I wasn’t able to publish this update on Sunday as usual. And what a dramatic week it has been! The feared September sell-off finally arrived…

But enough of that Nonsense, let’s be honest: while we technically had a “negative week” for the first time in a while (at least in the U.S.), the reality remains unchanged and is put in simple words: Nothing ever happens!

Latest Data and News in Review – What Moved the Markets?

Even the much-anticipated PCE inflation numbers on Friday came in completely in line with expectations, offering no surprises for the market.

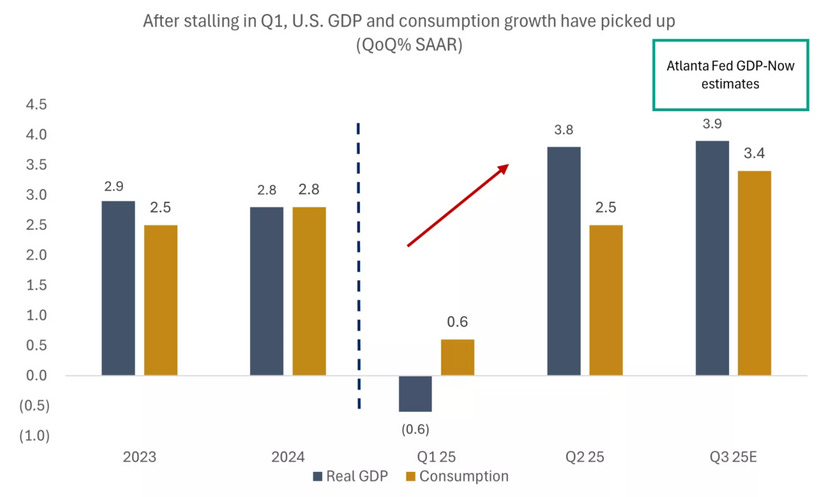

On Thursday, the updated U.S. GDP data delivered large upward revisions, completely erasing the minor dip we saw in Q1. As Edward Jones perfectly illustrated in their chart, this “Q1 slowdown” now looks more like a footnote in history rather than a real economic concern.

It’s worth noting (as we’ve discussed in previous outlooks) that the negative Q1 growth was largely driven by tariff frontloading. When tariffs were essentially confirmed at the start of the year, many companies pulled forward their planned imports, temporarily dragging down GDP, a one-off distortion rather than a sign of structural weakness.

The current market mood feels eerily similar to the start of this year. Back then, just like now, it seemed almost unthinkable that stocks could actually fall, until they did.

And as we’ve seen repeatedly over the past few years, every dip has been bought up quickly, including this past April.

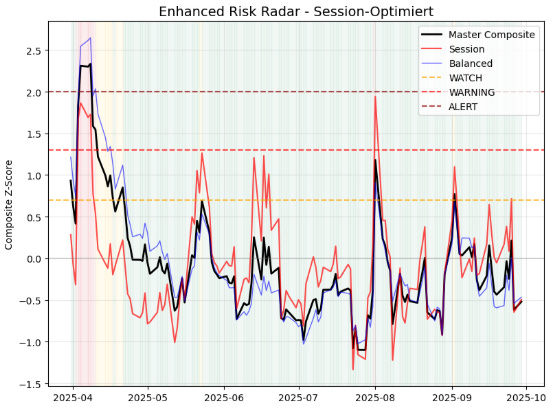

Gauch-Research Risk Meter update:

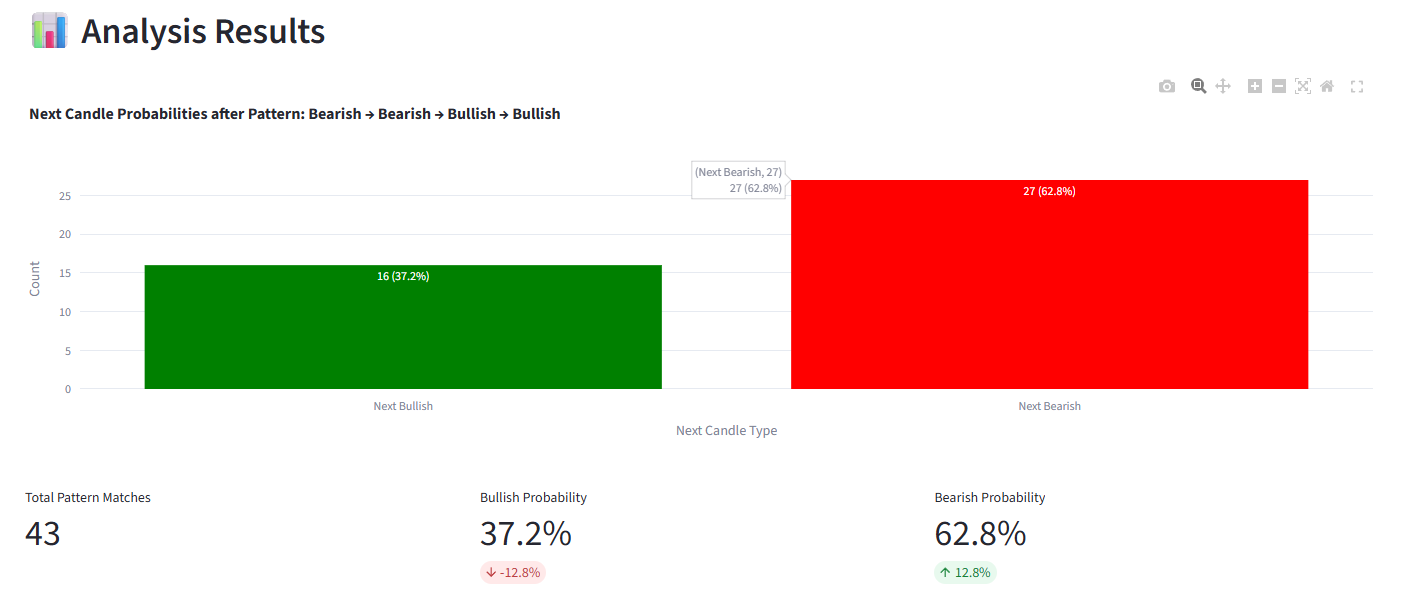

Our Gauch-Research Probability Analyzer for EURUSD currently signals an increased probability for further downside on the daily timeframe. This tool will soon be available to all Premium Subscribers, giving you direct access to our probability models and risk metrics.

What’s Coming Up This Week?

Hopefully, next week brings a bit more excitement. There is one potential catalyst, though it remains unclear if the market will care:

If Congress fails to pass a budget by October 1st, the U.S. government will once again face a government shutdown.

(Important note: this is not the same thing as the debt ceiling.)

When this happens, many “non-essential” government employees are sent home without pay until lawmakers in Washington finally reach a deal.

Why This Happens:

To pass a budget, 60 out of 100 Senate votes are required.

Even when one party controls both chambers (as the Republicans currently do), they rarely hold 60 seats, meaning they need cooperation from the opposition, which inevitably uses this moment to push through their own demands. This is exactly what happened during Biden’s first two years, and now it’s happening again under President Trump, just with reversed roles.

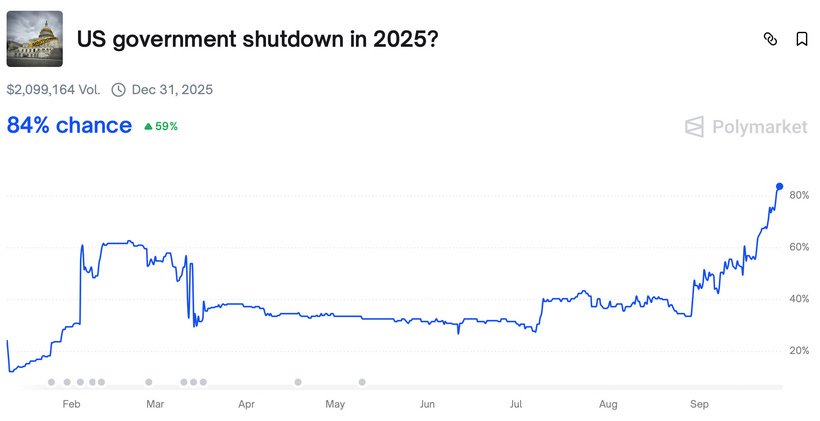

According to Polymarket, the probability of a shutdown is currently quite high:

If a shutdown occurs, the biggest immediate impact on markets would likely be that Friday’s labor market report (NFP) cannot be released on time.

This would be significant, as the report is expected to show:

+51K new jobs, confirming continued labor market weakness

Unemployment rate (U3) holding steady at 4.3%

Wage growth flat at +3.7% YoY

Such weak numbers would almost guarantee another Fed rate cut at the October FOMC meeting.

Other Key Data Next Week:

Tuesday:

Eurozone CPI

US JOLTS Job Openings

CB Consumer Confidence

Wednesday:

ISM Manufacturing PMI’s

Friday:

Non-Farm Payrolls

ISM Services PMI’s

Institutional Positioning:

Bullish:

DOW

CHF

PLATINUM

USD

SPX

Bearish:

EUR

COPPER

GOLD

AUD

CAD

Let’s Talk Charts:

USD:

After we cleared our first downside target the market strongly reacted after taking out the last major low…

For me the next play would be to target our initially marked Upside Target Area

Gold:

Still the same gameplan as the last few weeks…still too high to reenter longs

TLT:

Didn’t exactly reached our first entry area, took off a bit early

Would be realistic if the market dips down once more

Stay informed and unlock alpha with Gauch-Research. 🚀

💯