Market Update

14.09.2025

This Week’s Market Outlook “The time has come…“

Hello again, dear friend and reader. Welcome back. The past week's inflation and labor data have given us a clearer picture of the current market environment. And the message is now unmistakable: it's time for rate cuts this week!

Latest Data and News in Review – What Moved the Markets?

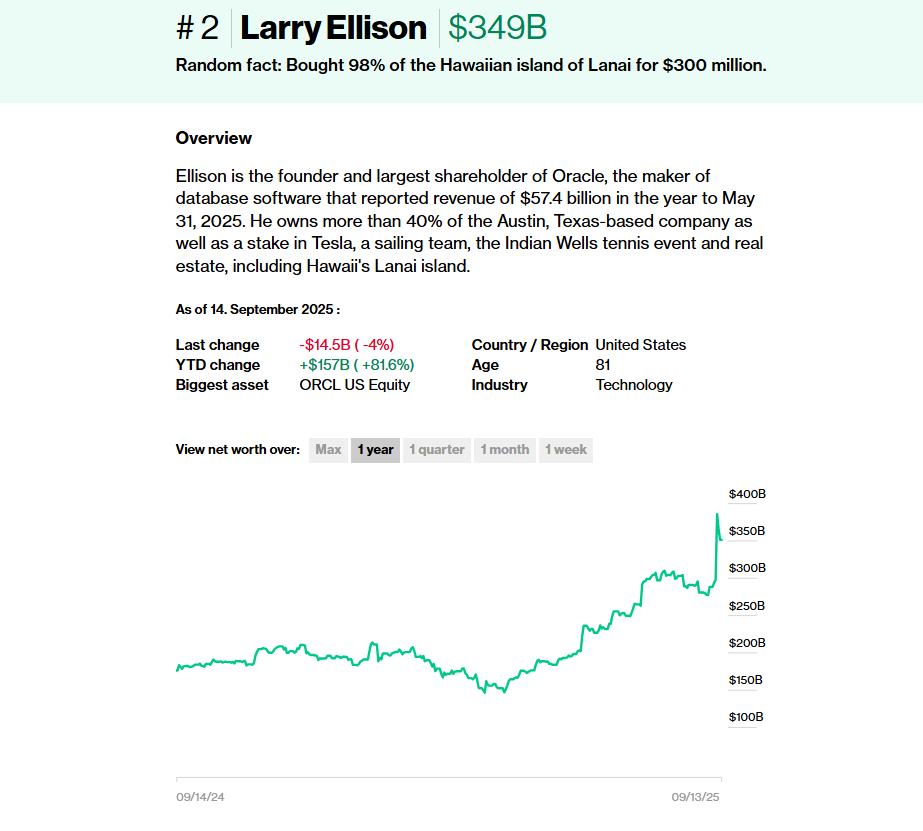

Almost everything is up, with the exception of bonds, which traded rather flat, and Oracle, which even saw a surge. This surge briefly made Larry Ellison, who according to Bloomberg hasn't sold a single stock in 25 years, the richest person in the world.

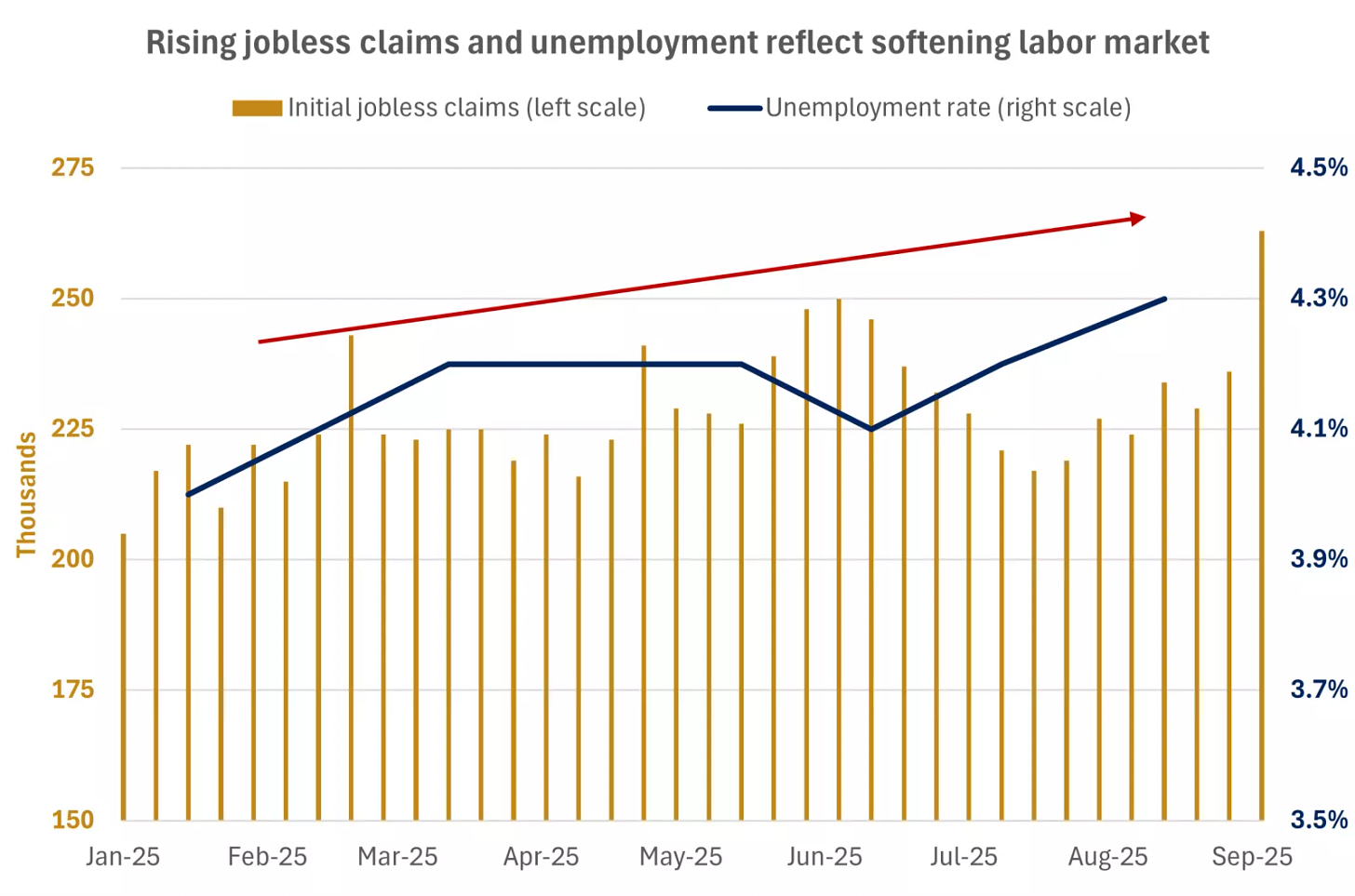

Also "positive" for the market was the long-awaited revision of US labor market data. The Bureau of Labor Statistics announced that from March 2024 to March 2025, approximately 911,000 fewer jobs were created than previously thought. When you also consider the rise in initial jobless claims, it becomes clear that the labor market is in a more critical state than many economists had assumed.

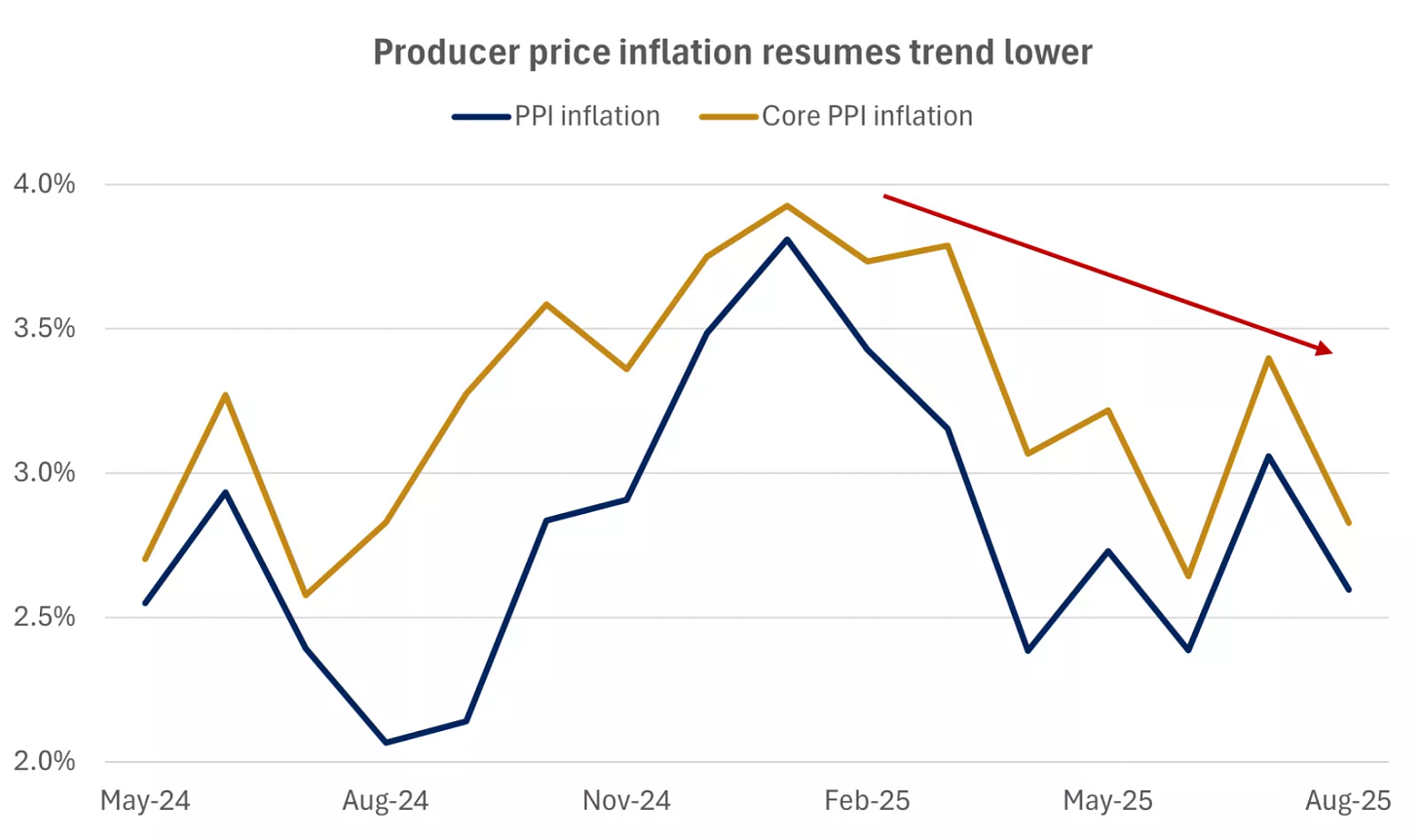

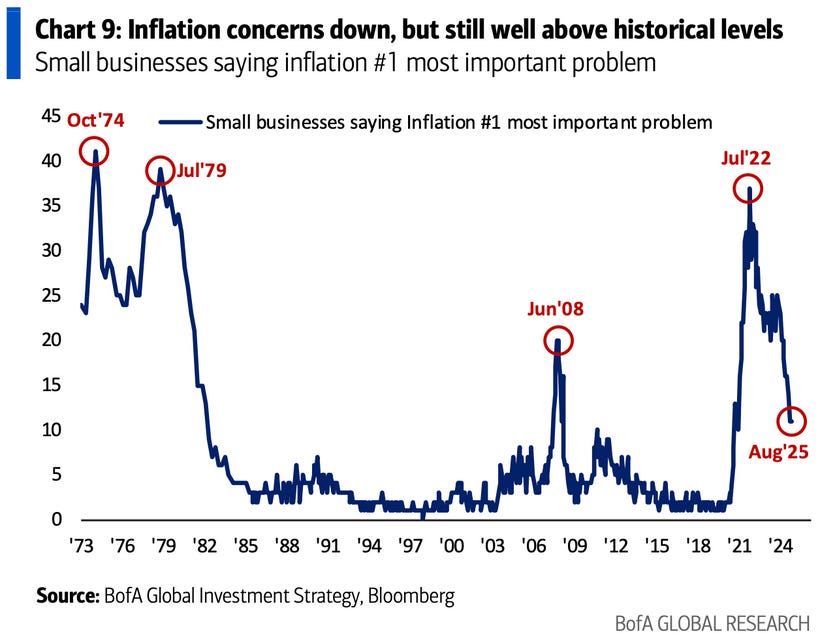

If you then look at the CPI inflation figures, which were largely "in-line" with expectations, and the PPI inflation figures, which were significantly lower than expected, there's nothing standing in the way of a rate cut in the coming days. We'll get to that in a moment.

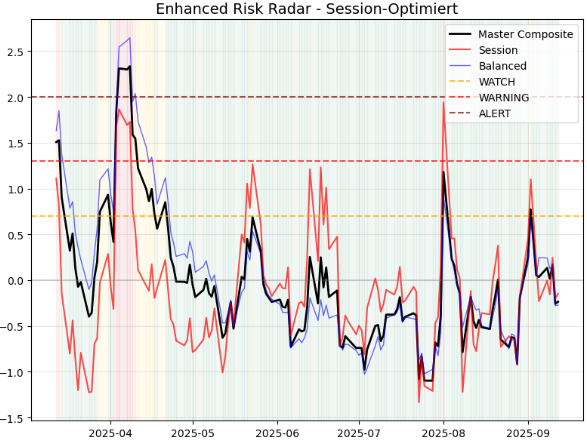

Gauch-Research Risk Meter remained calm, for now…

What’s Coming Up This Week?

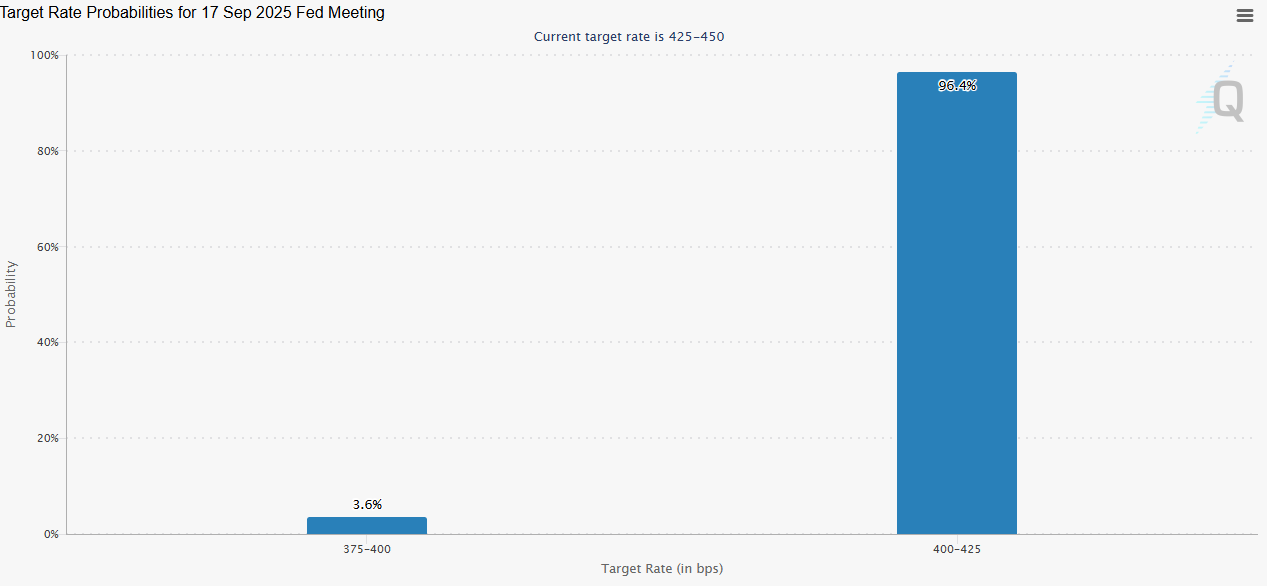

This week's main event is the long-awaited Federal Reserve rate cut on Wednesday. The big question is whether it will be a "simple" 25 basis point cut, or if Societe Generale will be right and Powell will even cut by 50 basis points, as he did last September. The market, like most economists, seems to be leaning towards the former.

The interest rate decisions of the Bank of England on Thursday and the Bank of Japan on Friday will be significantly less exciting for global stocks, as no changes are expected. Although, the Japanese are always good for a surprise...

Other things to look forward to this Friday are the quarterly OpEx, one of the four major options and futures expiration days of the year, and FedEx earnings on Thursday, which are often used as a gauge for the health of the US economy.

And that's pretty much it for the main events of the coming days.

Institutional Positioning:

Bullish:

DOW

JPY

NASDAQ

NIKKEI

Bearish:

OIL

PLATINUM

RUSSEL

NZD

CHF

Let’s Talk Charts:

USD:

Option B still in play…

Gold:

Waiting for pullbacks to enter further longs

Great play for rate cuts and a possible labour market crackdown

TLT:

Already picked up some TLT on the past lows

Looking to stack some more on further retracements

Stay informed and unlock alpha with Gauch-Research. 🚀