Market Update

22.10.2025

This Week’s Market Outlook “Who would have thought…”

Good morning, dear readers of Gauch Research, buckle up, because… well, actually, you don’t need to buckle up. It’s been yet another week of precious little happening. Yes, you read that right.

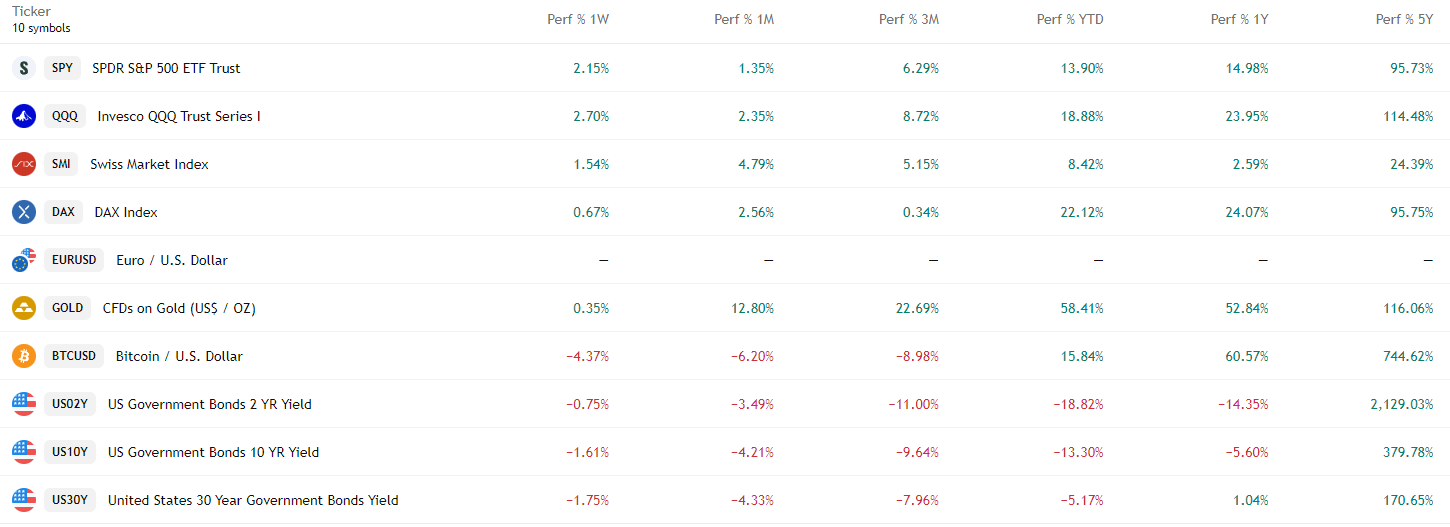

Once again, what we long suspected has been quietly reaffirmed: nothing ever happens. The “smaller” flare-up in the U.S.–China trade turmoil turned out to be just what we foresaw, tactical posturing ahead of the still-looming Donald Trump–Xi Jinping meeting. Markets shrugged. Monday saw a rebound in the U.S., and despite a “choppy” week the major U.S. indices closed in the green.

Europe and China? Not so lucky. Their stocks lurched sideways or worse. Meanwhile, gold keeps sprinting from one all-time high to the next, even though we got a major sell-off yesterday of roughly –6%! Now the question on everyone’s mind: is this the start of a broader retracement, or just a quick shakeout before the “debasement trade” resumes?

It’s hard to call it either way. On one hand, the move looks like a classic positioning flush, too many latecomers piling into the “gold only goes up” narrative. On the other, if real yields keep grinding higher and the dollar refuses to die, that shiny “store of value” might suddenly look a bit heavy.

For those unfamiliar: debasement means a serious erosion of purchasing power, think runaway deficits, massive debt loads, currency weakening. In that scenario, assets quoted in the weakening currency suddenly look much more valuable.

Sad fact: the famed flip-to-sound-money coin of crypto, namely Bitcoin, appears to have missed the memo. If this really is a debasement cycle, it would be deeply ironic if that asset doesn’t pop.

Latest Data and News in Review – What Moved the Markets?

As U.S.–China trade drama cooled, credit risks stepped back into the limelight. No full-blown collapse like back then at the Silicon Valley Bank, yet. But we’re seeing ominous warning signs: defaults by firms like Tricolor Finance (sub-prime auto lender) and First Brand (Apparel) (auto-supplier, alleged accounting fraud), trouble at regional banks (e.g., Zions Bancorporation, Western Alliance Bancorporation) and exposés of creeping credit stress. The remark by Jamie Dimon about “cockroaches” in the credit market didn’t exactly calm nerves.

Publicly traded private-credit firms (BDCs) are getting battered year-to-date. Regional banks? They’re still holding up okayish, based on the available ETFs. But… and this is key, it would be classically ironic if banks were the next crash victims, given that the latest Bank of America Fund Manager Survey shows “long banks” as the most consensus trade.

What’s Coming Up This Week?

We’ve got two core themes—unless some surprise headline (hello again, U.S.–China shuffle or bank jitters) steals the show.

1) U.S. Inflation data (Friday): Delayed due to the government shutdown (still ongoing). Headline CPI expected to climb from +2.9% to around +3.0% YoY; core CPI expected to dip slightly from +3.1% to +3.0%. Numbers still well above the central bank target, but no tariff shock yet.

2) Earnings season: Micro focus returns. From the tech side, keep an eye on Tesla, Inc. and IBM Corporation today, and Intel Corporation on Friday.

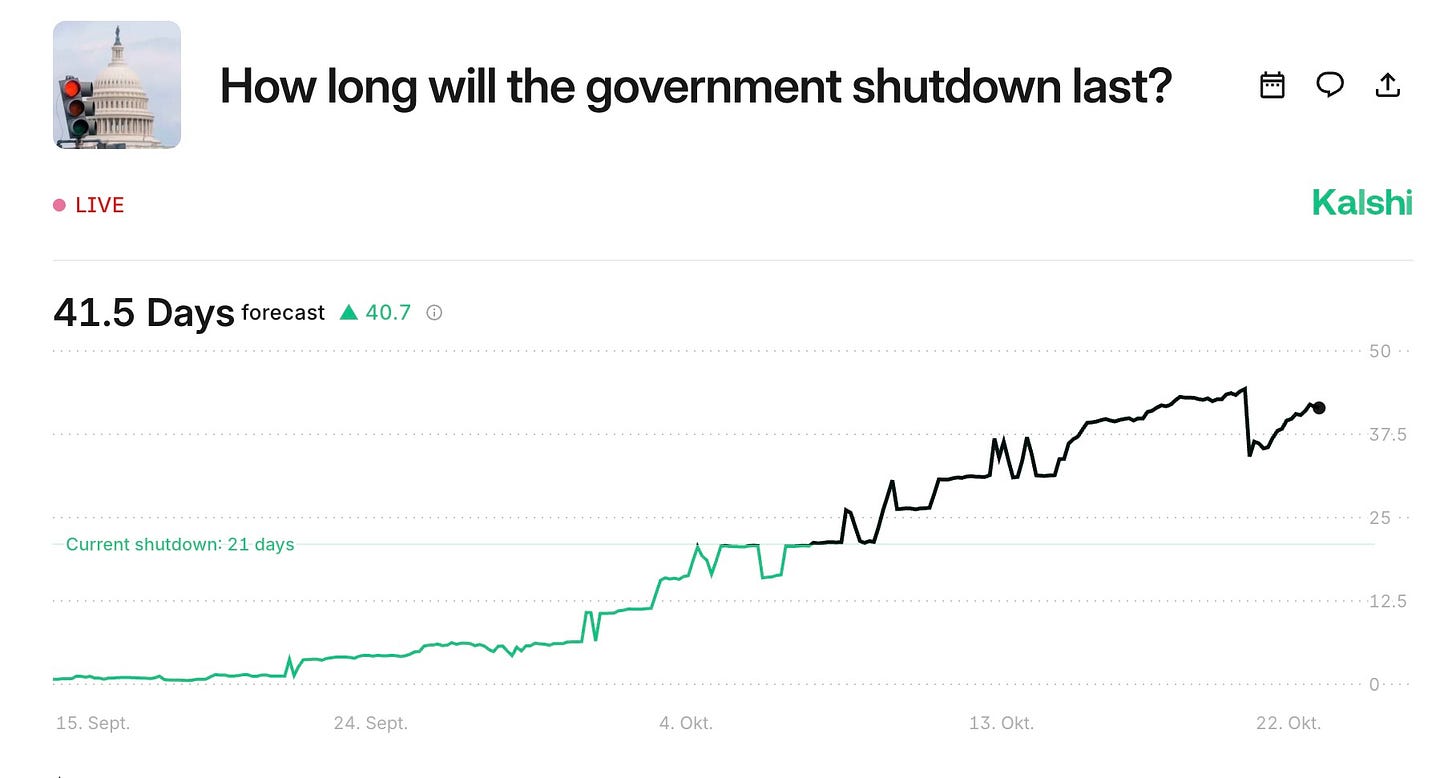

Shutdown dragging on

According to Kalshi, the U.S. government shutdown is still dragging its feet, with no deal in sight in the Senate. Current market pricing suggests it could last another 20 days, not exactly confidence-boosting.

This matters because upcoming data will likely be noisy. Expect temporary swings in the NFP prints, especially as federal layoffs and delays distort the numbers. In short: take near-term jobs data with a grain of salt.

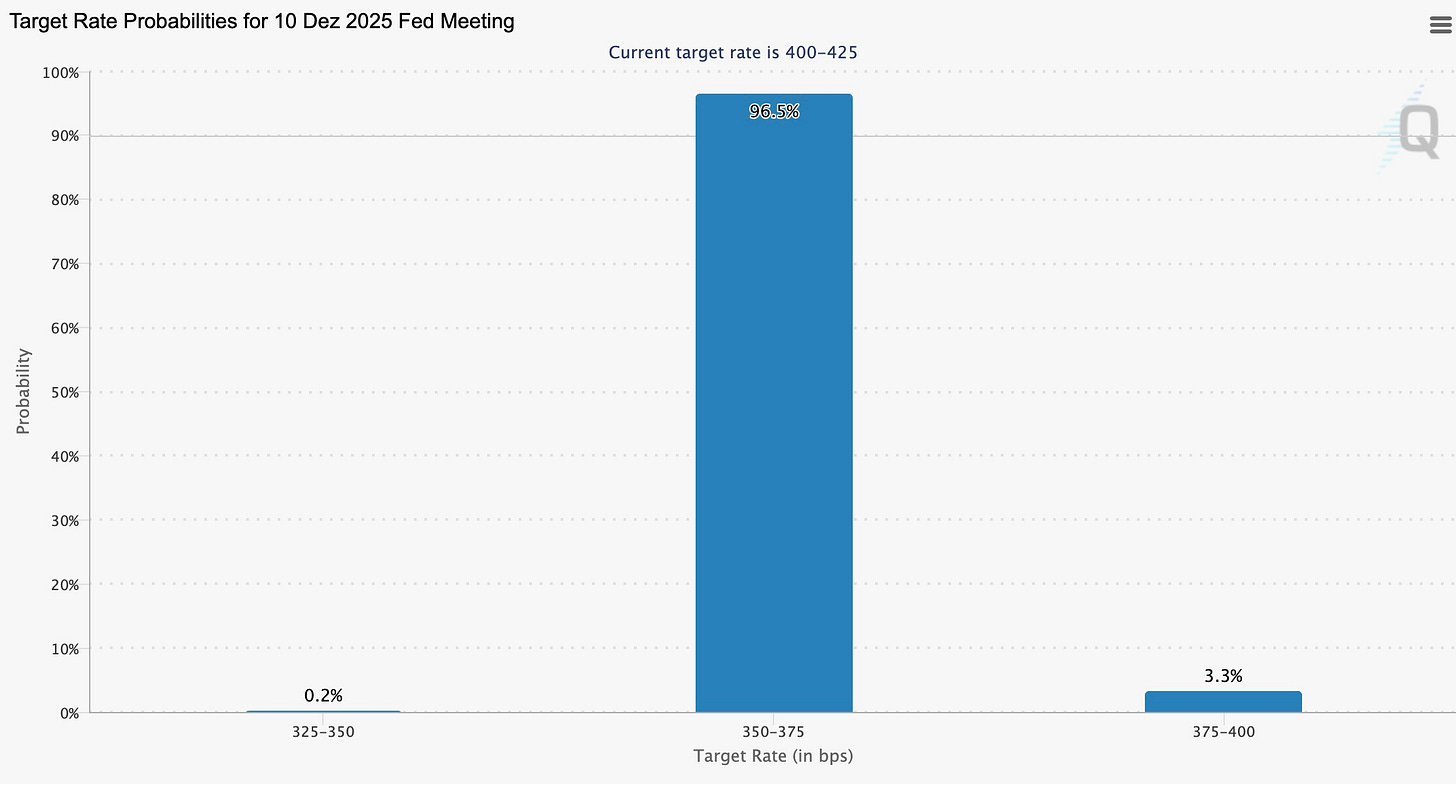

Rates, USD, and the macro pulse

Markets have now priced in two full additional rate cuts, and you can see the impact crystal clear in FX. The USD stabilized after the latest sell-off, now marching back toward the 100 handle, which marks our next short-term upside target.

Gauch-Research Risk Meter

Bottom line

This market still does not like doing anything meaningful. Complacency has had its moment, but with geopolitical tension, credit risk rising and earnings about to hit, movement is finally back on the table. Whether that morphs into a genuine re-pricing event or simply another volatility spike remains to be seen. But rest assured: Q4 has kicked off, and the herd is awake again (sort of).

A note to readers

It’s worth saying, the recent forecasts have played out beautifully. Every major move we outlined has unfolded almost point-for-point. But please, don’t just copy the charts. Understand why the market reacts at those levels. There’s always a reason: liquidity pockets, macro positioning, or behavioral psychology.

Trading is less about being right and more about understanding why you were right. That’s what keeps your edge alive.

Also, friendly reminder: daylight saving time adjustment this weekend for us (Europe). We’re getting the “good” one (extra hour), but it means after that the U.S. will only be five hours behind Europe for a while.

Let’s Talk Charts:

USD:

Our last idea worked out beautiful, we got a great reaction from our zone towards the next upside target

Reentry possible in the smaller grey area

EURUSD:

Also great reaction from our previous stated zone

Downside target remains the same

Reentry possible

Gold:

In case of a larger Gold sell-off, this could be a great play

Entry area should be used with low risk!

TLT:

Long play worked our perfect with the weakening of yields

Stay informed and unlock alpha with Gauch-Research. 🚀