Market Update

24.08.2025

This Week’s Market Outlook “Time for a Change…”

Hello again, dear friend and reader. I am back from my holidays, refreshed and ready to dive into the markets once more. The past two weeks have not been quiet at all, quite the opposite. We’ve had data surprises, shifting tones from the Fed, and more political drama. Time to break it down.

Latest Data an News in Review – What Moved the Markets?

The latest NFP report was outright disappointing, confirming what many feared: the labor market is losing momentum. This puts the Fed’s single-mandate side, employment stability, firmly back in focus. For months, Powell used labor strength as a reason to lean hawkish. That argument is now slipping away.

On the inflation front, the picture is becoming more complex. CPI came in stable, but PPI jumped by a striking 0.9%, a clear reflection of the tariff impact. At first, companies absorbed the higher costs. But now we’re at the stage where those costs are increasingly being passed on to consumers, which means we could see this spill into future CPI prints. This creates a tricky mix: a softening labor market paired with sticky inflationary pressures. Not exactly the clean-cut case for aggressive rate changes.

And yet, the Fed seems to be shifting. Powell’s latest comments marked a dovish turn and effectively opened the door, although unofficially, for a September rate cut. His reasoning leaned heavily on employment risks, the very argument he previously used to justify a hawkish stance. That pivot did not go unnoticed by the markets.

At the same time, political pressure is bubbling up again. Fed Governor Lisa Cook came under direct fire from Trump, who accused her of mortgage fraud and publicly demanded her resignation. Should she step down, Trump would gain the opportunity to appoint a replacement, something that could impact the Fed’s policy direction going forward.

Markets, of course, reacted swiftly:

The Dollar lost steam, reversing its earlier strength and sliding back towards recent lows.

EURUSD pushed higher, benefiting from the Dollar’s weakness.

Gold once again proved its worth as a safe haven, a setup we anticipated and discussed in our Idea Chat, which delivered a textbook long opportunity this week.

US500 rallied strongly on Powell’s dovish tone, which makes sense for now. But the rally rests on fragile ground: if labor data deteriorates further, recession chatter could quickly return, lifting the VIX and weighing on equities.

So overall, we are entering an increasingly two-sided market: soft labor data argues for easing, while inflation risks due to tariffs argue for caution. Add political noise to the mix, and you’ve got a mucho gusto recipe for volatility.

What’s Coming Up This Week?

A relatively calm week ahead, but still worth watching:

Tuesday: US Durable Goods Orders

Thursday: US Preliminary GDP

Friday: US Core PCE Price Index

Let’s Talk Charts:

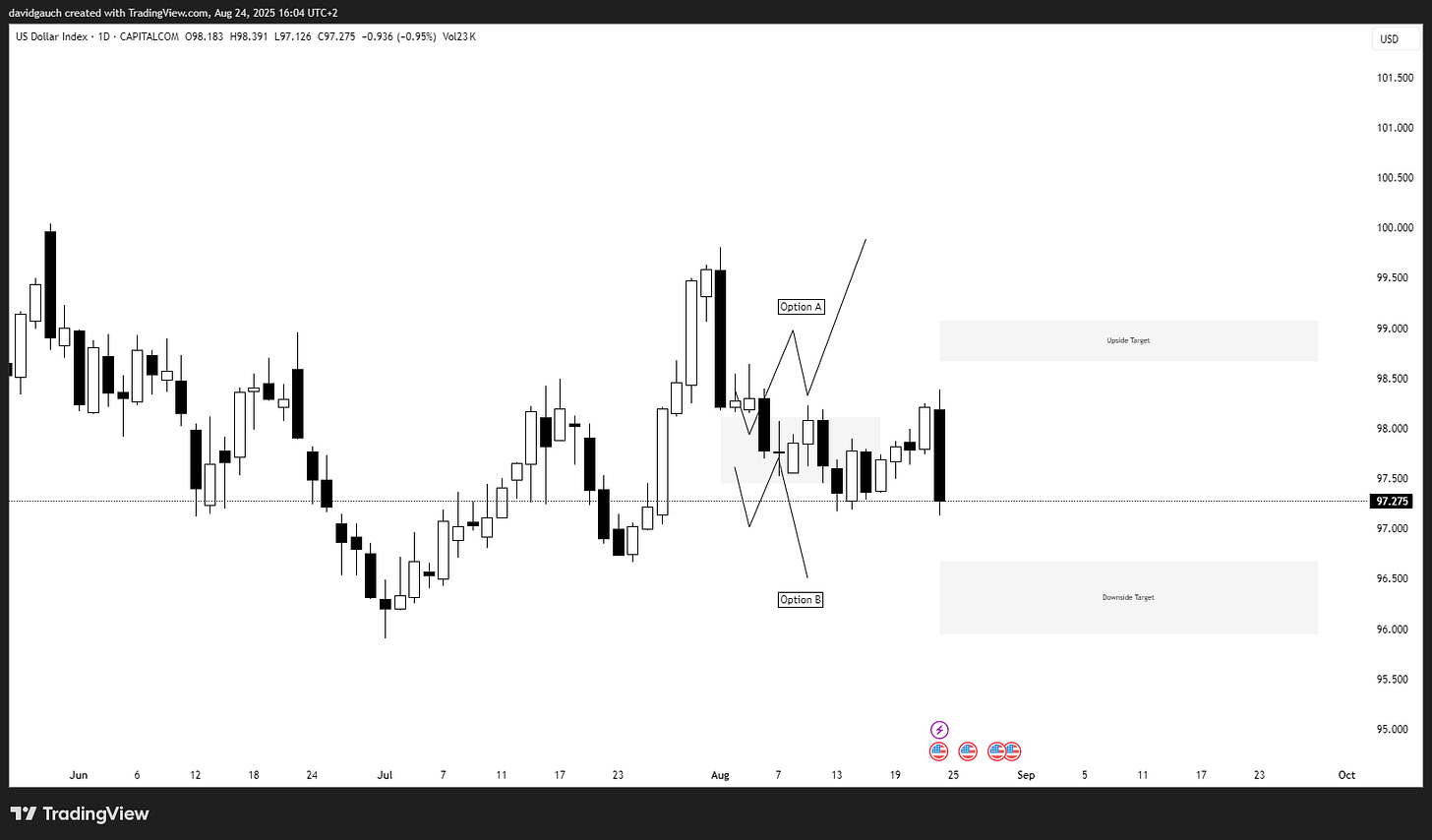

USD:

Option B from the past Outlook seems to be playing out now, first target will be to the downside

Gold:

Trading Idea played out pefectly as predicted in my Subscriber-Chat (first image)

Also the higher timeframe playbook from my past Market Update worked out great

Now the first target should be towards the grey area marked on my chart (second image)

Stay informed and unlock alpha with Gauch-Research. 🚀