Market Update

21.09.2025

This Week’s Market Outlook “Finally, it happened…“

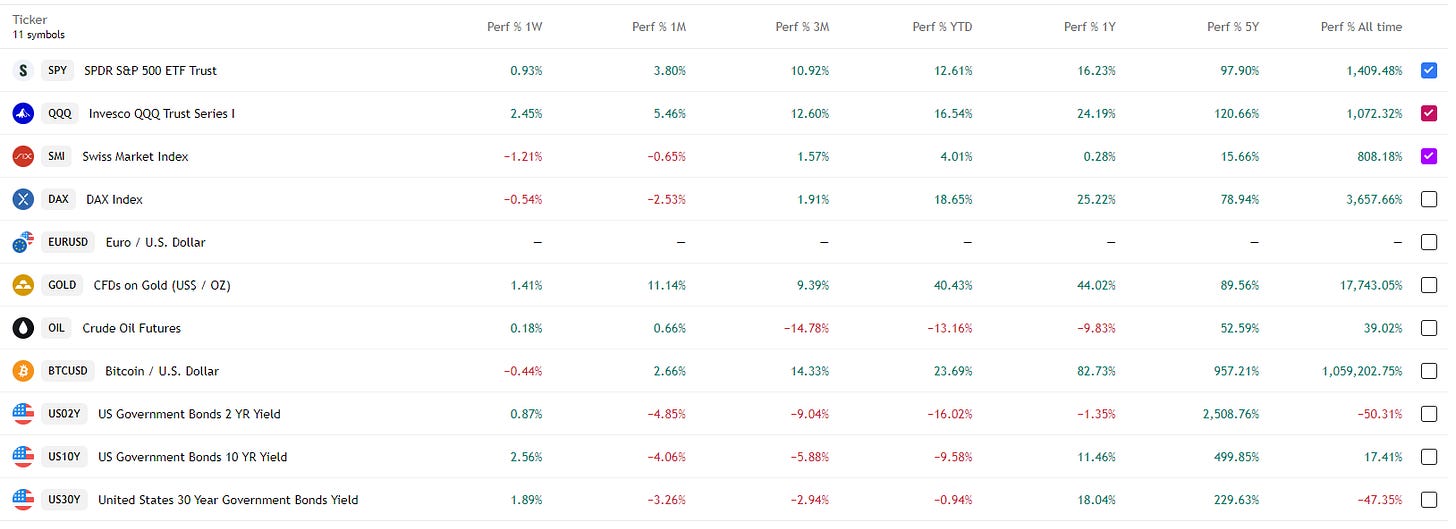

Hello dear friends and readers, and welcome back to another market update on this beautiful Sunday. Finally, as expected, the Fed delivered 25bps rate cut this week, the first one since last September, which was a 50bps one. Aside from that, it was a relatively calm week in terms of market volatility. In today’s update, I’ll walk you through the key events, what really moved the markets, and what to look out for next week. As always, grab a coffee and enjoy!

Latest Data and News in Review – What Moved the Markets?

The highlight of the week was undoubtedly the FOMC meeting, where the Fed officially resumed its rate-cutting cycle. This move was widely expected, but what comes next remains highly debated among Fed members.

The Dot Plot revealed a median projection of two additional cuts this year. However, that median is slightly skewed by one notable outlier, which likely came from Stephen Miran, who is known for his more aggressive stance on cuts.

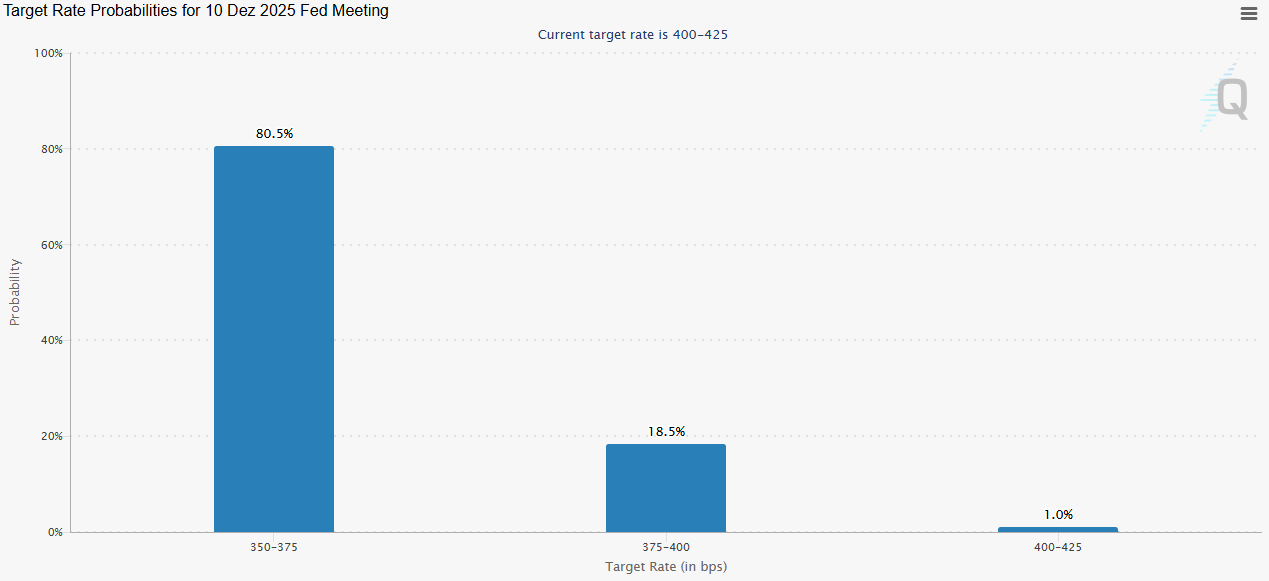

The market, on the other hand, is far more decisive:

There’s now a 80.5% probability that both of the remaining FOMC meetings this year (October & December) will result in 25 bps cuts each.

Beyond central bank decisions, there wasn’t much market-moving news.

One quirky story that caught attention was Donald Trump’s Intel trade, which he’s been bragging about after NVIDIA’s involvement sent it soaring over 50% in profits.

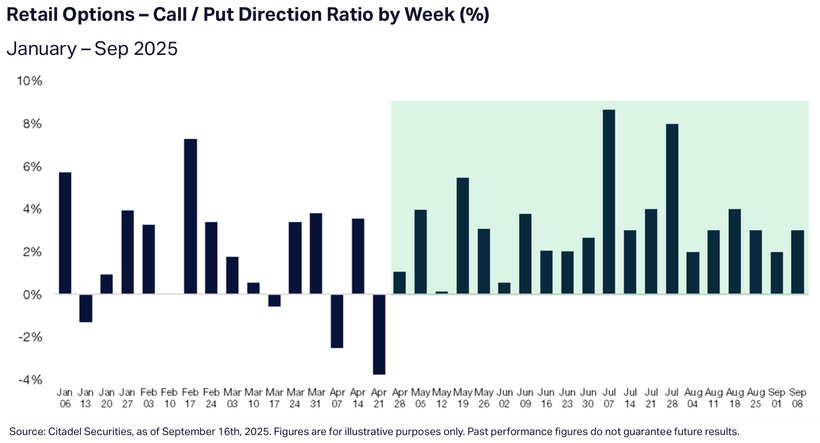

But aside from these side stories, the real question now is what happens next, especially after Friday’s massive options expiration, which likely reduced dealer gamma in the market.

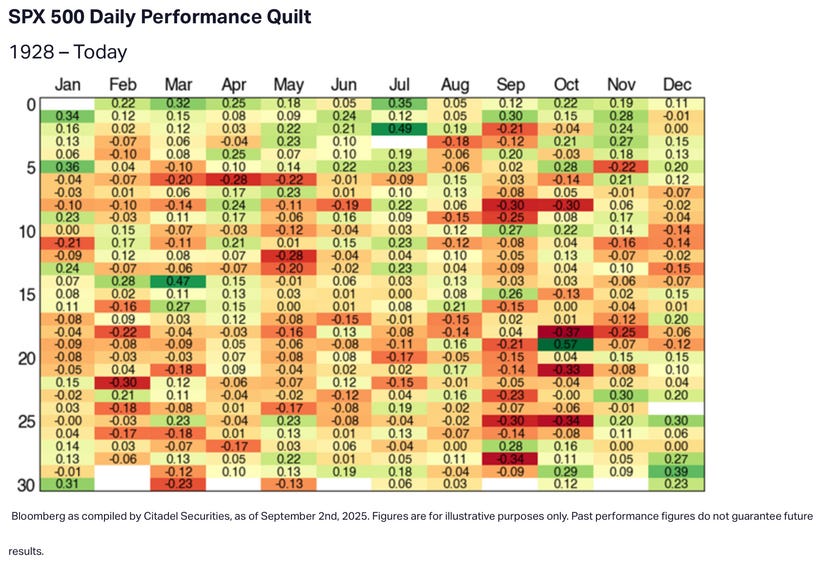

Could this spark the infamous September sell-off, or will markets remain stable? So far, it hasn’t materialized, but caution is warranted. According to Citadel’s internal statistics, which break down average daily returns of the S&P 500, the second half of September historically poses the biggest risk. This aligns with the well-known seasonal weakness narrative. However, whether we’ll actually see this weakness is far from certain. Institutional investors have been positioning for a potential drawdown for weeks, largely by buying protective put options (which so far have been nothing more than burned premium). Interestingly, retail traders have been doing the opposite, continuing to load up on call options without hesitation and so far, they’ve been right.

One important note of caution: the entire “September is always bad” narrative comes from a misinterpretation of averages. While the average return for September is indeed slightly negative, the hit ratio of positive Septembers is above 50%.

Put simply:

Most Septembers have historically been positive

But the few negative ones were so bad that they skewed the average downward.

So while the statistics warn of caution, it’s far from guaranteed that this September will be ugly. Let’s hope the hit ratio works in our favor this year!

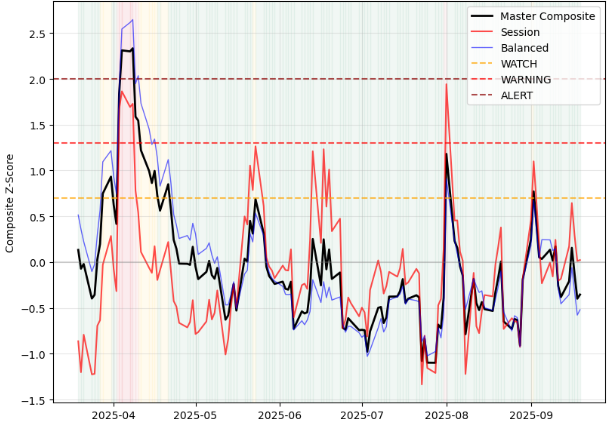

Gauch-Research Risk Meter remained calm…

What’s Coming Up This Week?

The coming week is light on major economic events (global Flash PMI’s), with just one key report standing out:

Friday: PCE Inflation Data

Headline PCE (incl. food & energy): Expected to rise from +2.6% to +2.8% YoY

Core PCE (excl. food & energy): Expected to tick up from +2.9% to +3.0% YoY

The Fed’s current forecast suggests that core PCE will end the year at +3.1%, before gradually declining toward their 2.0% inflation target in the following year. This is the key justification behind their renewed rate-cutting cycle. They argue that the recent inflationary spikes caused by tariffs are likely one-off price moves, while the labor market remains weak enough to warrant lower rates. Whether they are right about this path remains to be seen...

Institutional Positioning:

Bullish:

NIKKEI

AUD

GBP

US10T

USOIL

Bearish:

SPX

RUSSELL

JPY

USD

NZD

DOW

Let’s Talk Charts:

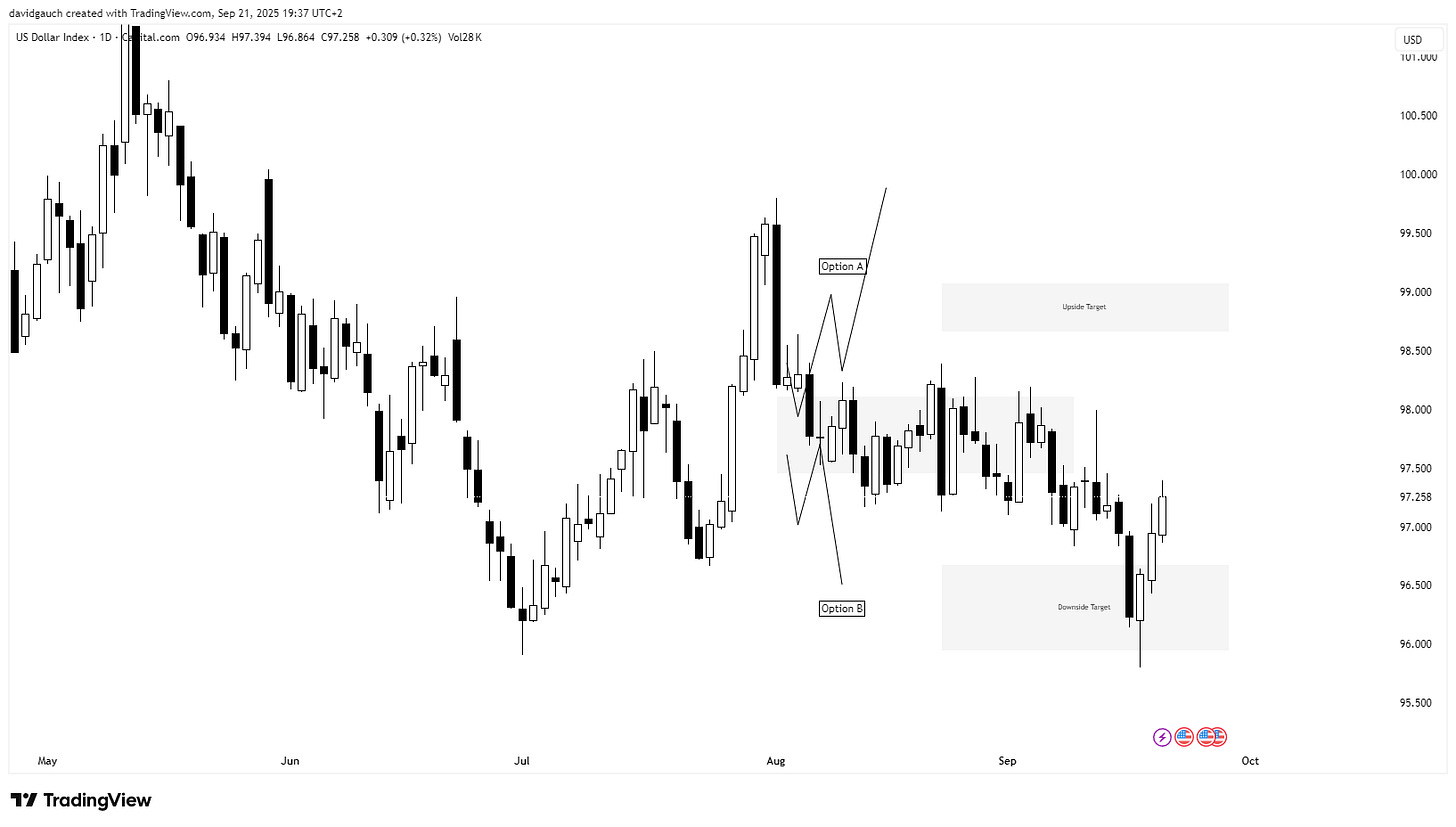

USD:

Option B played out in our favour, reaching our first downside Target

For now I still favor the downside. Some possible trading-ideas will be shared within our Premium-Chat

I was able to catch some trades on EUR/USD for the upside (second image)

Gold:

Didn’t get much opportunity, still too high for me to reenter longs

Currently waiting for a larger retracement

TLT:

Still eyeing the upside on TLT, the market is nearing my second area of interest

For now, the Fed has finally taken its first step toward easing policy again, setting the stage for a potentially pivotal Q4. Markets remain calm, but with dealer positioning shifting and inflation data on deck, volatility could creep back in quickly.

Enjoy the rest of your Sunday and have a great start to the week ahead!

Stay informed and unlock alpha with Gauch-Research. 🚀