Market Update

Fear is Back

Welcome back, everyone. It’s been another eventful couple of weeks in markets and once again, the Fed managed to dominate the headlines. Since the last FOMC meeting, the narrative has shifted sharply. The dollar regained its strength, equities took a short breather, and rate-cut expectations are finally coming back down to earth. Let’s unpack what’s really happening beneath the surface.

Latest Data and News in Review - What Moved the Markets?

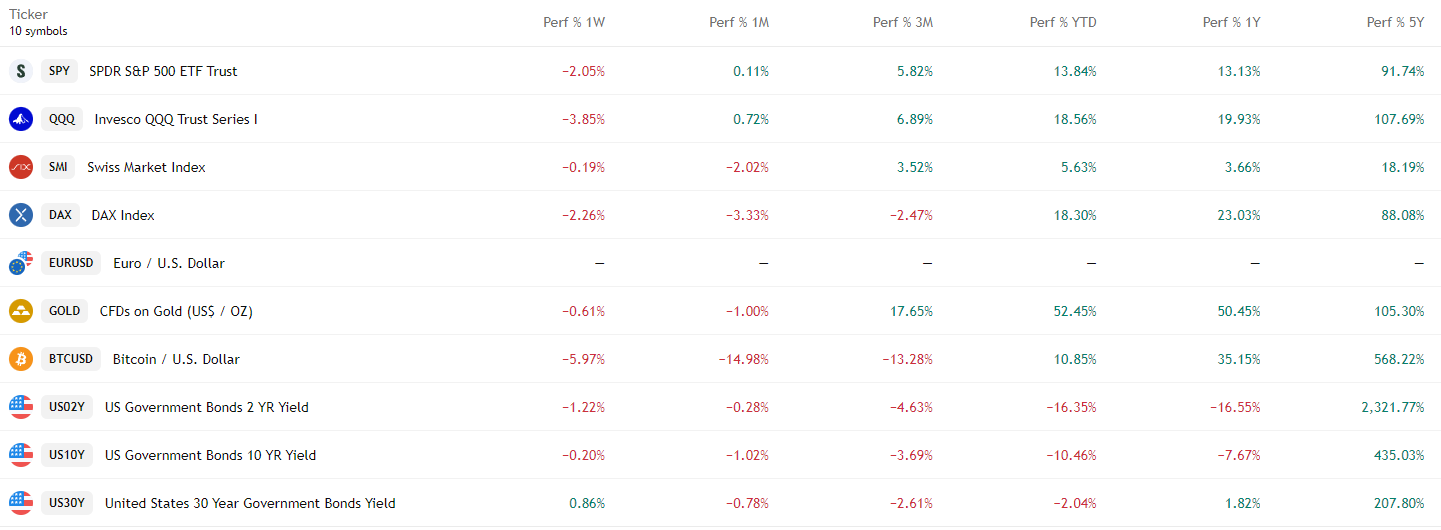

Since the last FOMC meeting, global markets have undergone a notable shift in tone. The US dollar has regained significant strength, driven primarily by the repricing of rate-cut expectations for the December meeting. This development was largely anticipated by us, and recent price action confirms that the market had become overly optimistic regarding further near-term monetary easing.

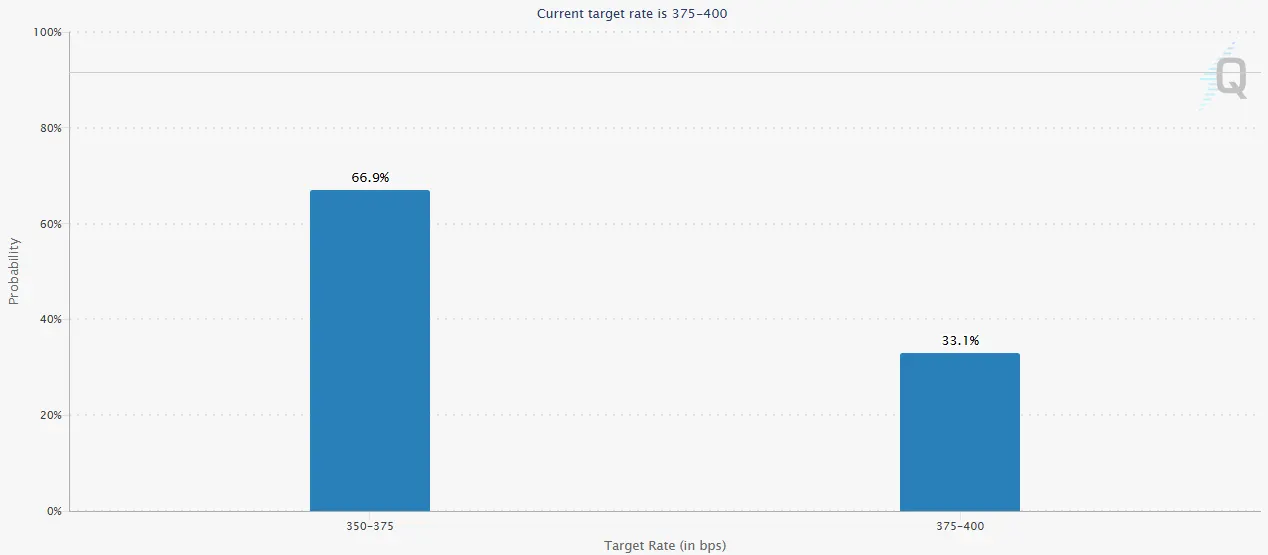

One month ago, the implied probability for another rate cut in December stood above 81 %. Following Jerome Powell’s remarks, this probability declined sharply to around 66.9 %, reflecting renewed market discipline and alignment with the Fed’s own cautious stance. In our assessment, this repricing process is not yet complete. We expect the likelihood of an additional rate cut to continue decreasing in the coming weeks, which should provide further support for the US dollar.

Powell’s Message: Inflation Above Target, Labour Market Still Solid

Chair Powell’s communication during and after the meeting was clear. The inflation battle is not yet won and the labour market remains robust. While there are occasional pockets of weakness in certain sectors, aggregate data continue to show resilience, far from what one would expect in a pre-recessionary environment.

The temporary government shutdown complicates the data picture, as several key macro releases, most notably the Non-Farm Payrolls report, remain unavailable. However, alternative indicators continue to paint a consistent story. The ADP Employment Change, which tracks private-sector payrolls, the ISM employment sub-indices, and weekly unemployment claims all signal a labour market that remains stable with no signs of structural deterioration.

In short, the Federal Reserve is not under immediate pressure to deliver another cut in December. Monetary policy remains data-dependent, but the available evidence does not justify a renewed easing cycle at this point.

Earnings Season: Still Strong Despite Market Fatigue

Equity markets ended last week modestly lower, a move that is neither alarming nor unusual after a strong earnings season. Historically, such pauses tend to occur once investors have priced in the majority of positive corporate surprises.

Roughly 90% of S&P 500 companies have reported their results, with 77% exceeding revenue expectations and 82% beating on earnings per share. This broad-based strength reinforces the narrative of an economy that, while slowing at the margins, remains far from contraction territory.

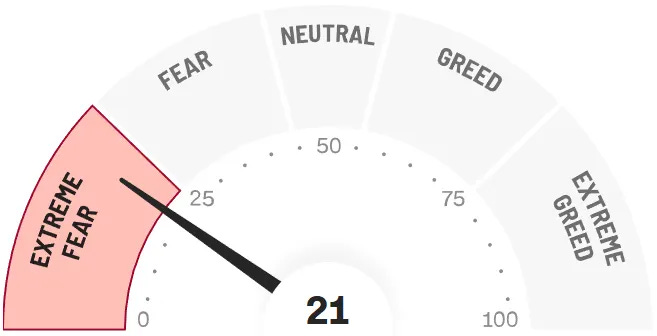

Nevertheless, short-term sentiment has turned more cautious. The Fear & Greed Index shows that market participants have shifted back toward fear after even minor pullbacks. For long-term investors, such retracements are entirely normal and often present selective opportunities to add exposure to high-conviction positions. (Not investment advice.)

US Tariff Case: A Legal Battle with Economic Implications

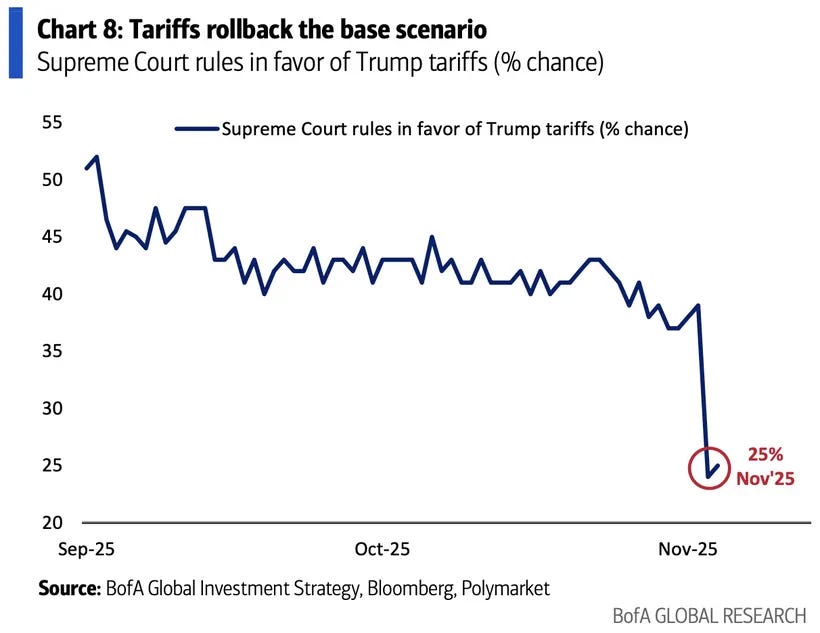

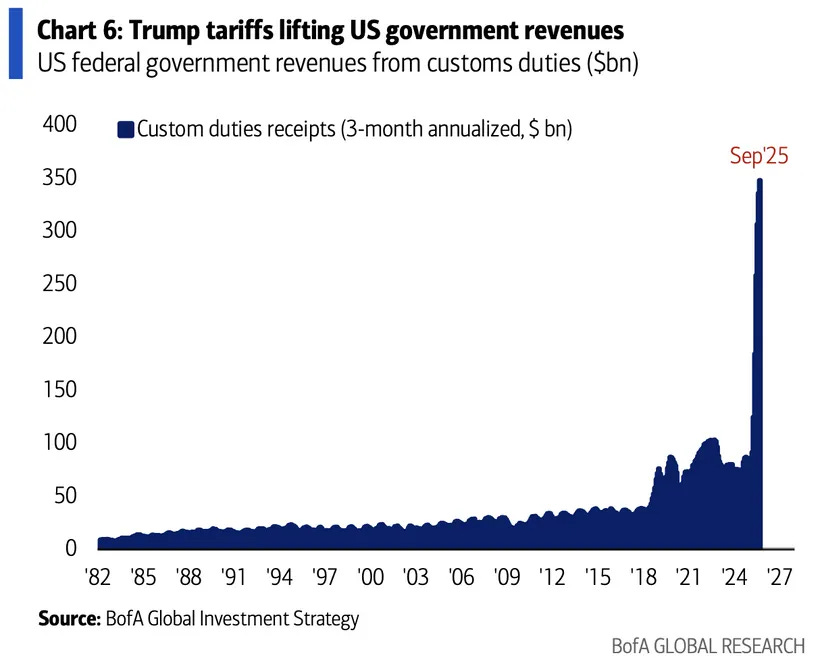

Another event that gained attention last week was the first Supreme Court hearing regarding the ongoing US tariff law dispute. Initial questioning by the justices suggested a potentially unfavourable outcome for the US government, as the court appeared critical of the legal framework underpinning certain tariffs.

From a macro perspective, a ruling against the current tariff regime could carry notable implications. Tariff revenues have risen sharply in 2025, becoming a non-negligible source of fiscal inflows. A legal setback would therefore not only have trade policy ramifications but could also tighten fiscal conditions indirectly.

However, the case does not challenge the tariffs themselves but rather their legal foundation. Even in the event of an adverse ruling, the administration retains multiple, albeit more complex, mechanisms to maintain much of the existing structure. In other words, while this case has the potential to create volatility, it is unlikely to result in a fundamental shift to the current tariff landscape.

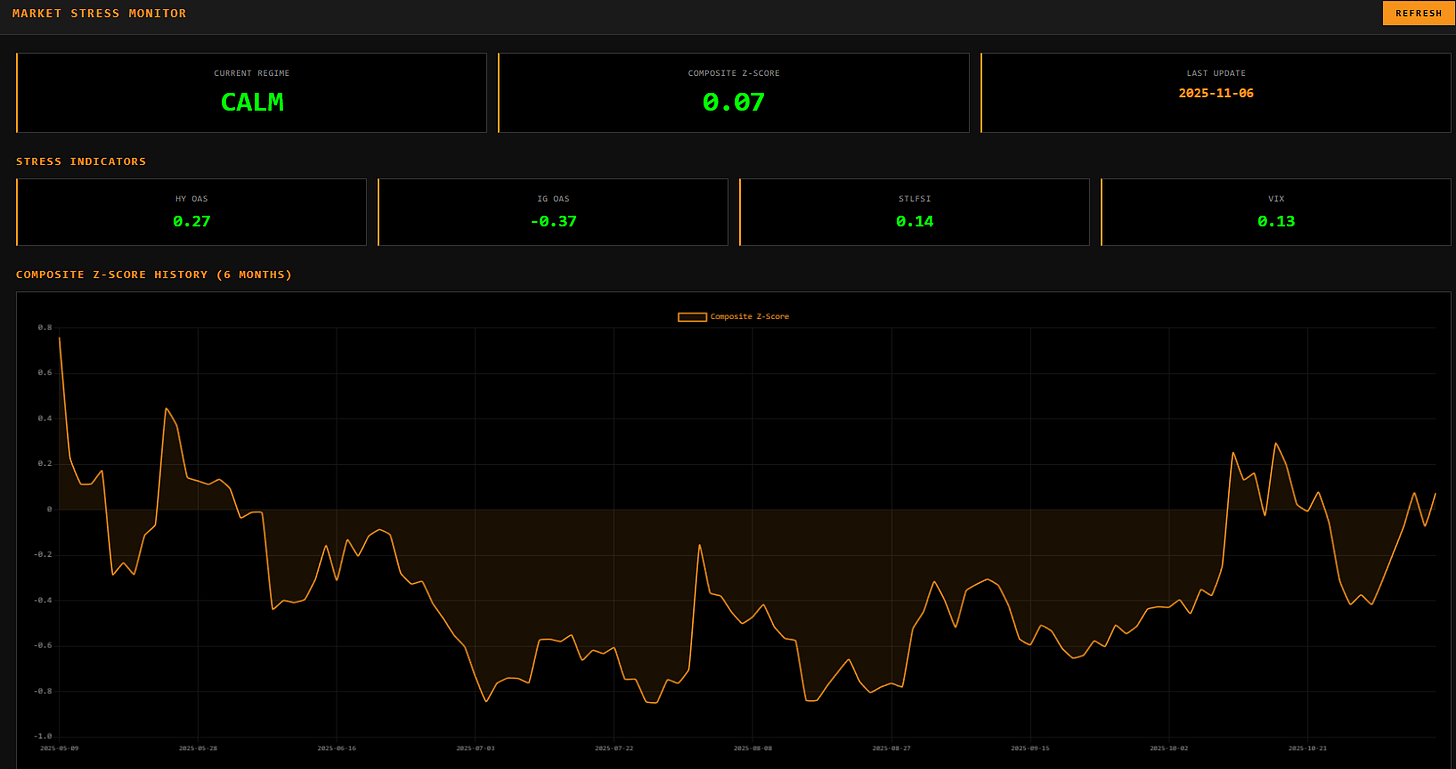

Gauch-Research Risk Meter

What’s Coming Up This Week?

The upcoming week’s macroeconomic calendar remains light. With limited data releases due to the shutdown, market focus will likely remain on secondary indicators and residual earnings reports. The next major event on the horizon will be NVIDIA’s earnings release, scheduled for the week after next – a data point that could re-energize sentiment in both the technology sector and broader equity markets.

Gauch-Research View

Our strategic outlook remains unchanged. We maintain a long-term bullish view on the S&P 500, a constructive stance on the US dollar, and a bearish bias on the euro-dollar exchange rate. Short-term volatility may persist, but the broader narrative continues to point toward resilient US growth, limited policy easing, and sustained dollar strength. Markets are gradually adjusting to a “higher for longer” reality, which still favours US assets over most global peers.

Lets Talk Charts:

USD:

EURUSD:

S&P 500:

Stay informed and unlock alpha with Gauch-Research.