Market Update

Focus Fed

Welcome back, everyone. It’s time for another Gauch Research update and this week we actually have some meat on the bone. The spotlight is on the Fed, but a few other players decided to stir things up too. Let’s keep it tight.

Latest Data and News in Review - What Moved the Markets?

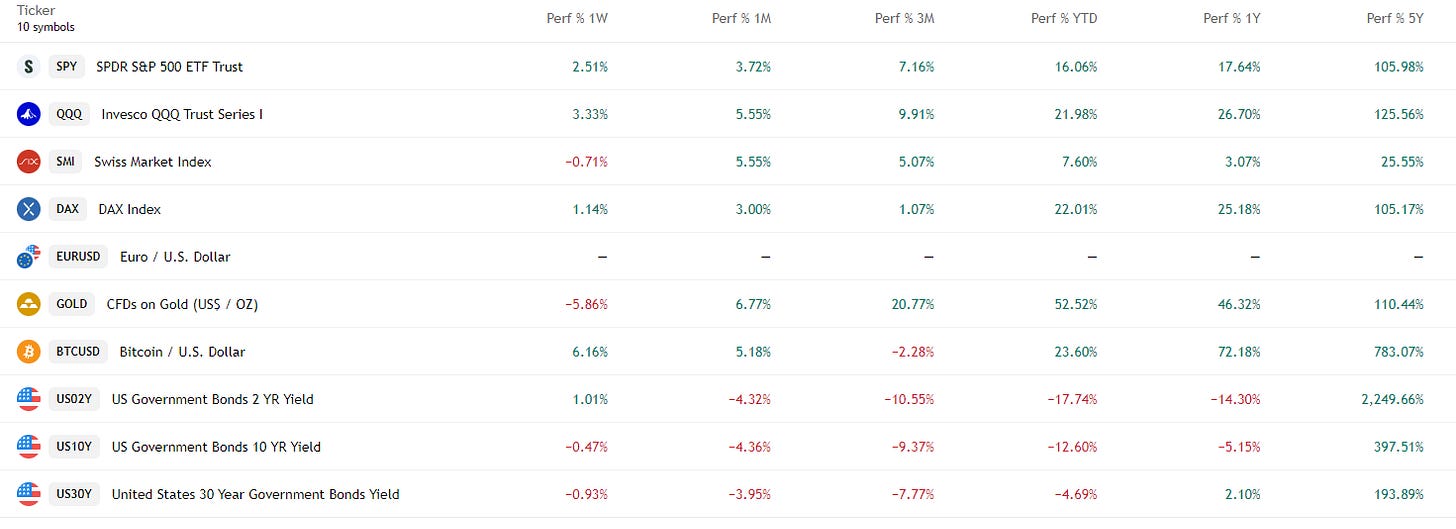

Equities kicked off the week with a strong gap up and yes, we can thank Trump for that. He’s currently doing his “deal tour” in Asia, closing agreements faster than CNBC can keep up. After Malaysia and Cambodia, China is his main focus this week. “I’ve got a lot of respect for President Xi, and I think we’re going to come away with a deal,” Trump told reporters on Air Force One en route to Japan from Malaysia. Markets loved it, S&P 500 ripped +1.1%.

So yeah, a clean risk-on start. Gold, unsurprisingly, got smoked, down about 3% intraday as money rushed back into equities.

What’s Coming Up This Week?

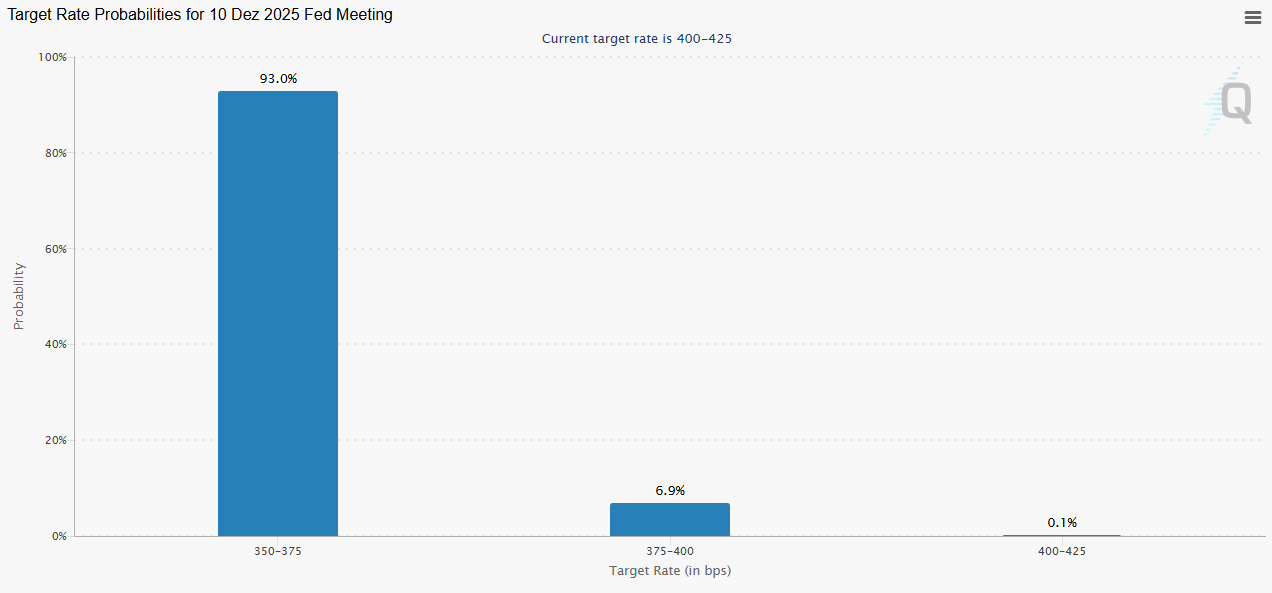

The main show this week is Wednesday’s FOMC meeting. Powell’s back on stage, and a 25bps cut is basically locked in, 97.8% to be exact. The last inflation print came in softer than expected, so the market’s already comfortable with the cut narrative.

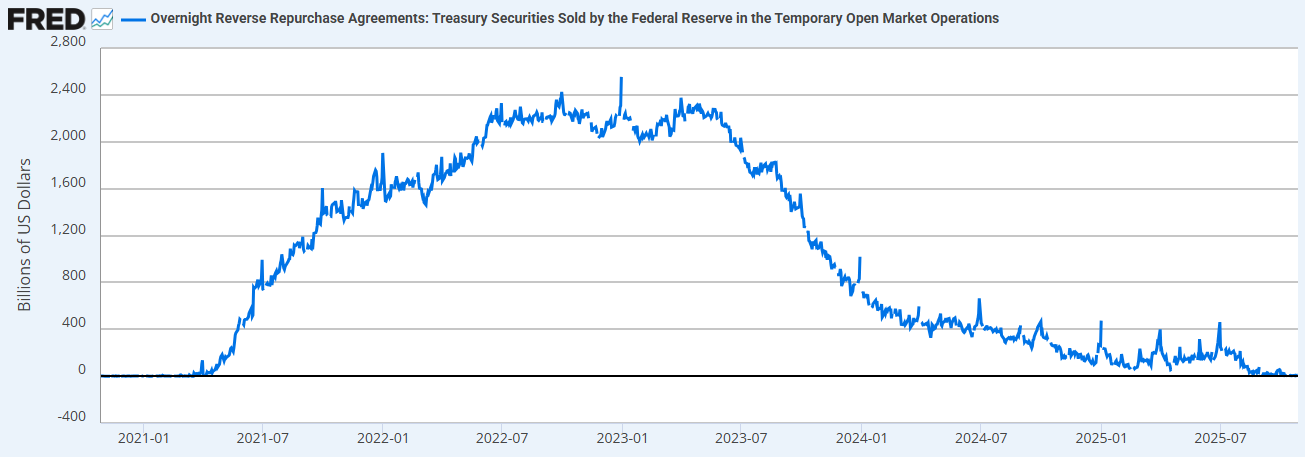

The Fed Pivot - QT on Its Last Legs

After three years of draining liquidity, it looks like the Fed’s finally pulling the plug on Quantitative Tightening. Powell hinted last week that QT might end soon — not because everything’s great, but because the plumbing’s running dry.

The backdrop:

Core CPI at 3.0% (vs 3.1% expected) — inflation cooling, slowly.

PMI stable — no real signs of a recession.

Fed balance sheet flat around $6.6T — liquidity hasn’t improved in weeks.

In short: the U.S. economy is fine, but liquidity isn’t. And Powell knows it.

Reading Between Powell’s Lines

You didn’t have to listen long to get his message:

Labor market’s losing steam. Job growth is stalling, participation is down, the engine’s sputtering.

Inflation isn’t the big bad wolf. Most of it’s still tariff noise, not real structural pressure.

QT halt incoming. Bank reserves are flirting with the “danger zone”, any further tightening risks breaking something.

Why the Fed’s Really Panicking

The “QT ending” headlines sound bullish, but here’s the ugly truth: the Fed’s losing control of short-term rates.

The reverse repo facility has almost dried up, money market funds are now buying short-term Treasuries (T-Bills), because they yield more than the Fed’s repo rate. That shift drains liquidity from the Fed’s side and pressures bank reserves.

If QT keeps running, reserves fall below safe levels and that’s a nightmare scenario for Powell. So yeah, he’s not pivoting because he wants to. He’s pivoting because he has to.

The result? Exactly what markets crave: more liquidity, lower yields, and another leg up in valuations.

My Take

This isn’t a victory lap for the Fed, it’s a move out of fear. Fear of a liquidity crunch.

Markets will keep celebrating as long as the money hose stays open, but let’s be real, the second it stops, so does the party.

I’m staying long, but I’m not drinking the Kool-Aid. Keep cash ready, don’t chase FOMO, and if you’re still on the sidelines, scale in slowly, not emotionally.

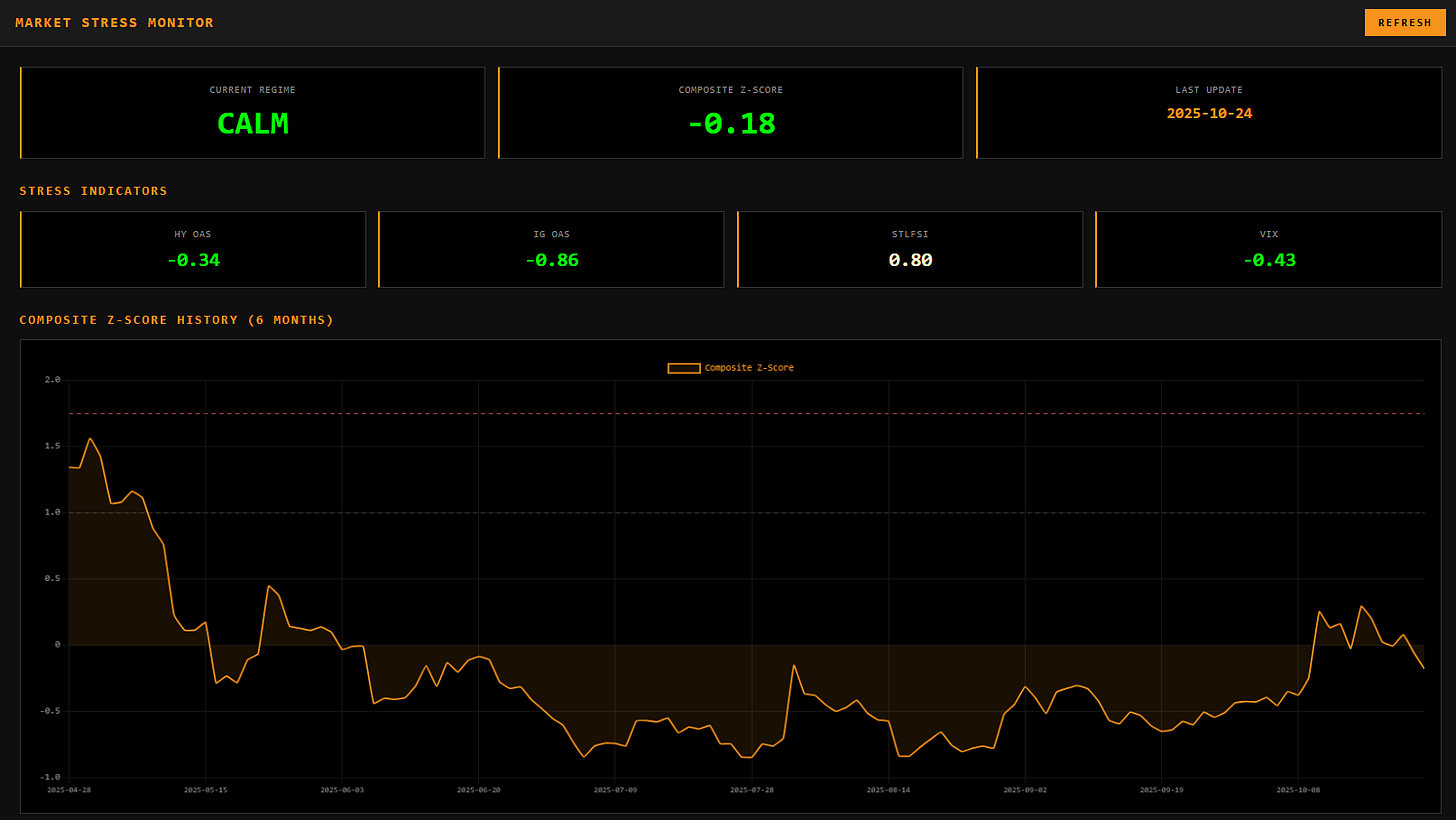

Gauch-Research Risk Meter

To Be Continued...

Earnings season is far from over. After Tesla last week, we’ve got Meta, Microsoft, and Alphabet reporting Wednesday after close, followed by Amazon and Apple on Thursday. Expect the usual headline beats, but the real focus will be on AI spending, how much capex they’re throwing at it and how fast they claim it’ll pay off.

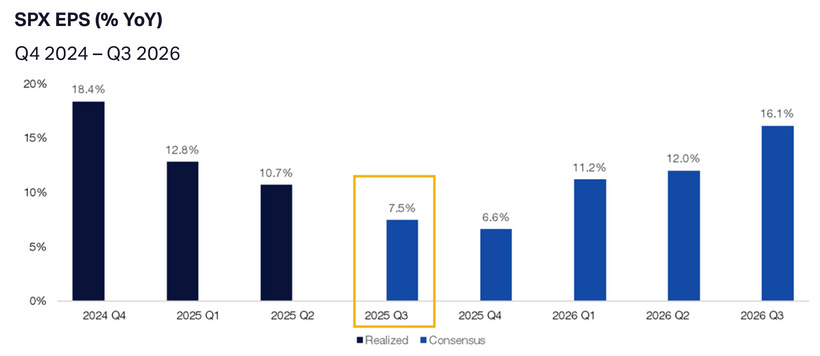

The market’s assuming every dollar spent on AI comes back with 10 in return. Spoiler: it rarely does. Overall earnings growth is sitting around +7.5% YoY, according to Citadel’s latest chart, not bad, but not “new cycle” material either.

Lets Talk Charts:

USD:

Still the same

Gold:

S&P500:

Stay informed and unlock alpha with Gauch-Research. 🚀