Market Update

13.10.2025

This Week’s Market Outlook “Here we go again…“

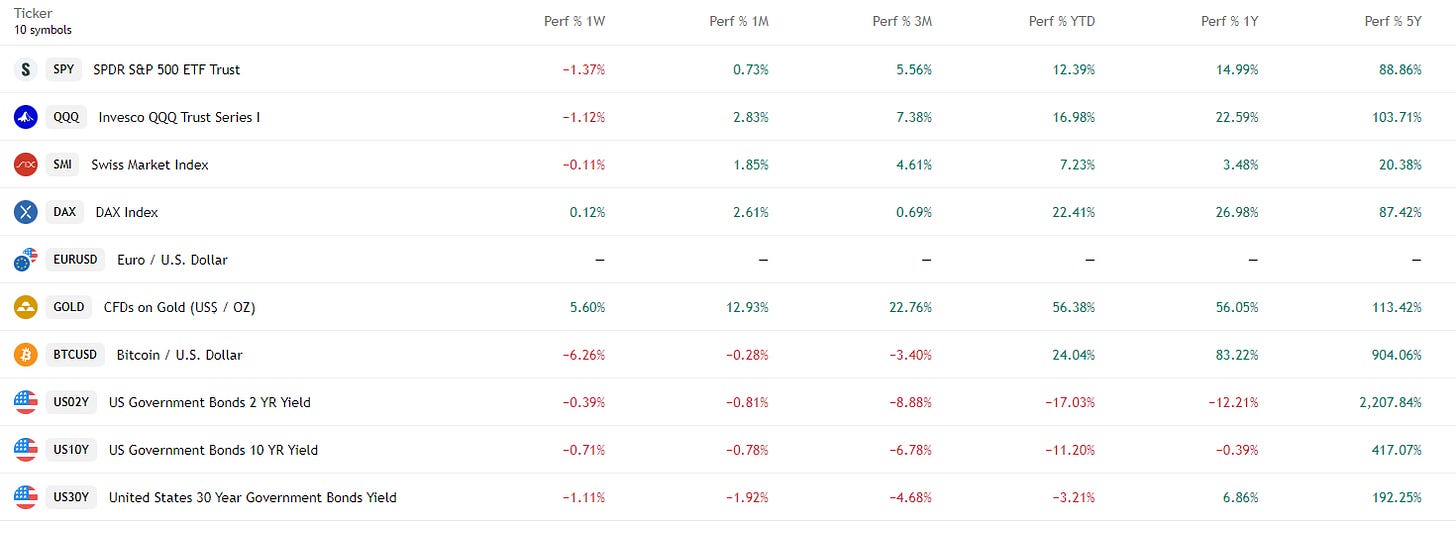

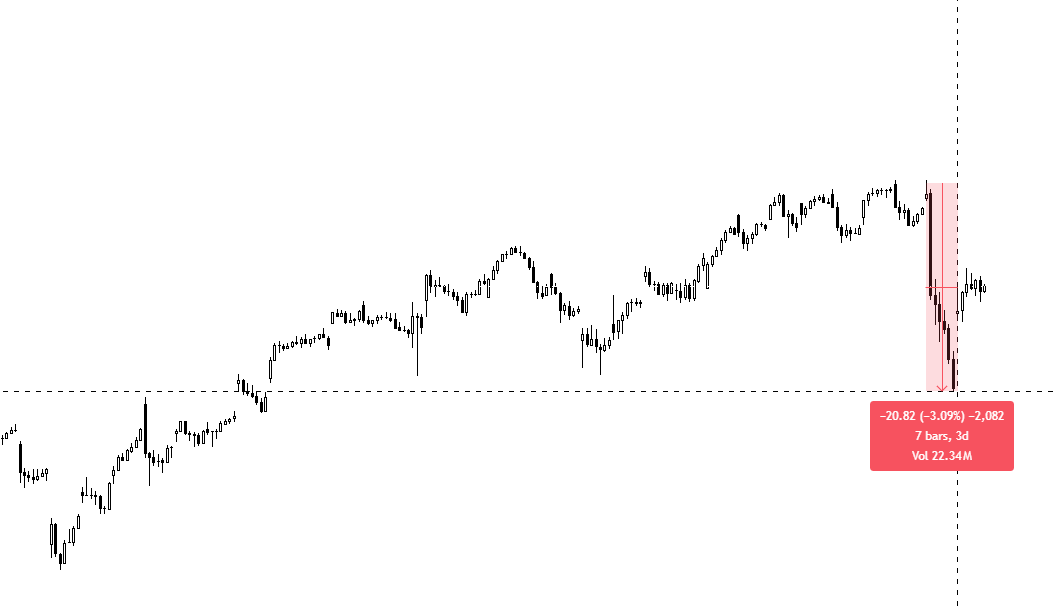

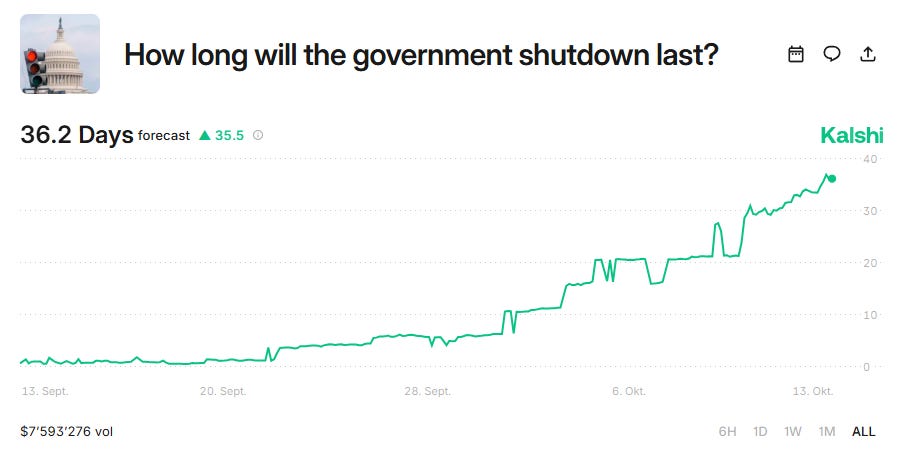

Hello dear friends and readers, and welcome back to another market update on this beautiful Monday. It has been a rather uneventful stretch in markets lately. With the U.S. government shutdown in full effect, economic data releases have been on hold, leaving investors without any real catalysts for movement. No new data means no fresh macro impulse and that has kept volatility suppressed for weeks. But that calm ended abruptly on Friday. Markets reacted swiftly as geopolitical headlines from Beijing and Washington reignited concerns about global trade tensions. The impact was immediately visible in the weekly performance numbers, as major indices turned lower and sentiment shifted from complacency to caution.

Latest Data and News in Review – What Moved the Markets?

What happened:

While most headlines last week revolved around familiar topics such as inflation, the Federal Reserve and the U.S. political stalemate, a more significant story slipped quietly through the news cycle. China unexpectedly expanded its export restrictions on rare earth materials, the strategic metals essential for electric vehicles, semiconductors and advanced weapon systems.

Reuters described the move as dramatic, and the choice of words was appropriate. The timing suggests a strategic play by Beijing to build leverage ahead of the expected Xi–Trump meeting. The United States responded almost immediately. The administration announced new tariffs on Chinese imports and publicly questioned whether the meeting would take place at all. Markets took notice and sold off sharply into the weekend.

The timing was particularly unfortunate for Michael Hartnett of Bank of America, who had just recommended Chinese banks as a buying opportunity the week before.

What’s Coming Up This Week?

The renewed tension between the world’s two largest economies, combined with ongoing political dysfunction in Washington and uncertainty in Europe, could be the catalyst that turns October into the volatile month it is historically known to be.

If the weakness continues, systematic and trend-following strategies may begin to unwind, potentially triggering the long-anticipated downside convexity that has been discussed for months.

However, history suggests that such events often turn out to be political theater. Late on Friday, President Trump clarified that the new tariffs might not be implemented if China shows flexibility and he stopped short of canceling the meeting with President Xi. The setup for a short-term rebound remains intact, which we saw today.

Macro focus

From a macro perspective, the U.S. government shutdown continues to delay key data releases such as labor market figures. Hopes for a resolution by mid-October have faded, although the Department of Defense has reportedly found interim funding to ensure that military salaries continue to be paid, removing one of the few points of leverage that could have forced faster negotiations.

The CPI inflation report scheduled for this week has been delayed. Interestingly, the Bureau of Labor Statistics still plans to release the September inflation data on October 24, as it is required for the Social Security cost-of-living adjustment.

Micro focus

The focus will now shift back to company fundamentals as earnings season begins. As usual, the large U.S. banks will open the season, with results from JPMorgan, Citi and Wells Fargo expected in the coming days.

This round of earnings will provide the first real test of corporate resilience in an environment of persistent inflation, higher input costs and waning consumer strength. The key questions remain whether margins can hold, how robust consumer spending will be into year-end, and whether investors are still willing to pay high valuations in a higher-for-longer rate environment.

Bottom line

After weeks of stagnation, markets finally moved. Whether this marks the start of a broader repricing or simply another brief volatility spike remains uncertain. October has a reputation for surprises, and this year is unlikely to be an exception.

Geopolitical tensions, domestic political instability and the start of earnings season are converging all at once. That mix does not promise stability, but it does guarantee movement.

Complacency has had its moment. The fourth quarter has just begun, and the market feels alive again.

Let’s Talk Charts:

USD:

Our dollar analysis from our previous market update played out very clean…

Before:

After:

For now I could see further upside…

EURUSD:

Trading idea for our premium subscribers played out perfectly as well…

Possible gameplan:

Stay informed and unlock alpha with Gauch-Research. 🚀